Market Overview

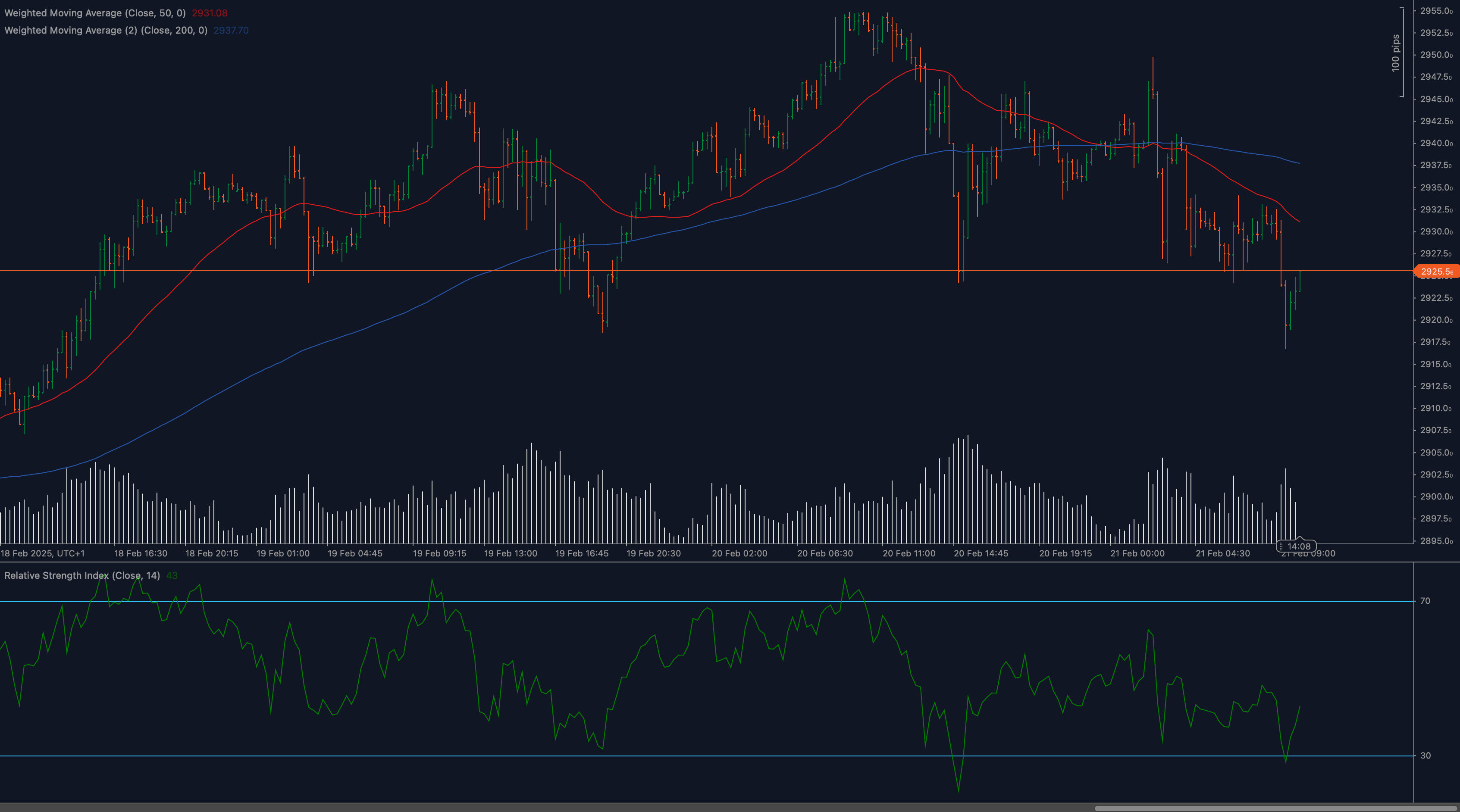

Gold prices have come under selling pressure, leading XAUUSD to test the key $2,925 support level. The metal recently faced resistance at higher levels, triggering a correction. With the RSI in oversold territory, traders are watching for signs of a potential rebound or a continuation of the decline.

Amid concerns about inflation and the Federal Reserve’s monetary policy, gold’s price action is influenced by investor sentiment toward interest rate expectations. Geopolitical uncertainty and global risk appetite continue to play a role in determining gold’s short-term direction.

Technical Analysis

🔹 Support & Resistance Levels:

- Support: $2,925 (current level), $2,900 (psychological support), $2,875 (next downside target)

- Resistance: $2,950 (short-term barrier), $2,975 (key level), $3,000 (major resistance)

🔹 Moving Averages:

- 50 WMA: Positioned at $2,931, acting as immediate resistance

- 200 WMA: At $2,937, indicating long-term support

🔹 Relative Strength Index (RSI):

- RSI is at 43, suggesting slight oversold conditions

- A move above 50 could confirm bullish momentum

- A drop below 40 would indicate increasing downside risk

🔎 Fundamental Factors:

💰 US Economic Data – Key inflation reports and job data will impact XAUUSD movement

🏦 Federal Reserve Policy – Speculation around future interest rate hikes remains a driver

🌍 Global Risk Sentiment – Safe-haven demand influences gold fluctuations

📉 US Dollar Strength – A stronger USD weighs on gold prices, while a weaker dollar supports gains

🏛️ Central Bank Demand – Gold purchases by global central banks continue to impact long-term price trends

📈 Market Outlook & Trading Scenarios

✅ Bullish Case:

- If XAUUSD holds $2,925 support and RSI rises above 50, a move toward $2,950 and $2,975 could unfold

- A breakout above $3,000 would confirm renewed bullish momentum

❌ Bearish Case:

- A breakdown below $2,925 would expose $2,900 and $2,875 as the next downside targets

- RSI dropping further into oversold territory could indicate continued selling pressure

📊 Trading Considerations

📌 Aggressive Traders: May look for long positions near $2,925, targeting $2,950, with a stop-loss below $2,900

📌 Conservative Traders: Should wait for confirmation of a reversal before entering long trades

📌 Short Sellers: A confirmed break below $2,925 could provide opportunities toward $2,900 and lower

Conclusion

Gold remains at a critical level, with traders closely monitoring price action at $2,925. If bulls defend this support, a recovery toward $2,950 or higher is possible. However, continued weakness could trigger a deeper correction. Given the impact of macroeconomic factors and market sentiment, traders should stay alert for key developments that could shape gold’s next move.

⚠️ Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Trading carries risk, and past performance does not guarantee future results. Conduct independent research before making investment decisions.