Executive Summary

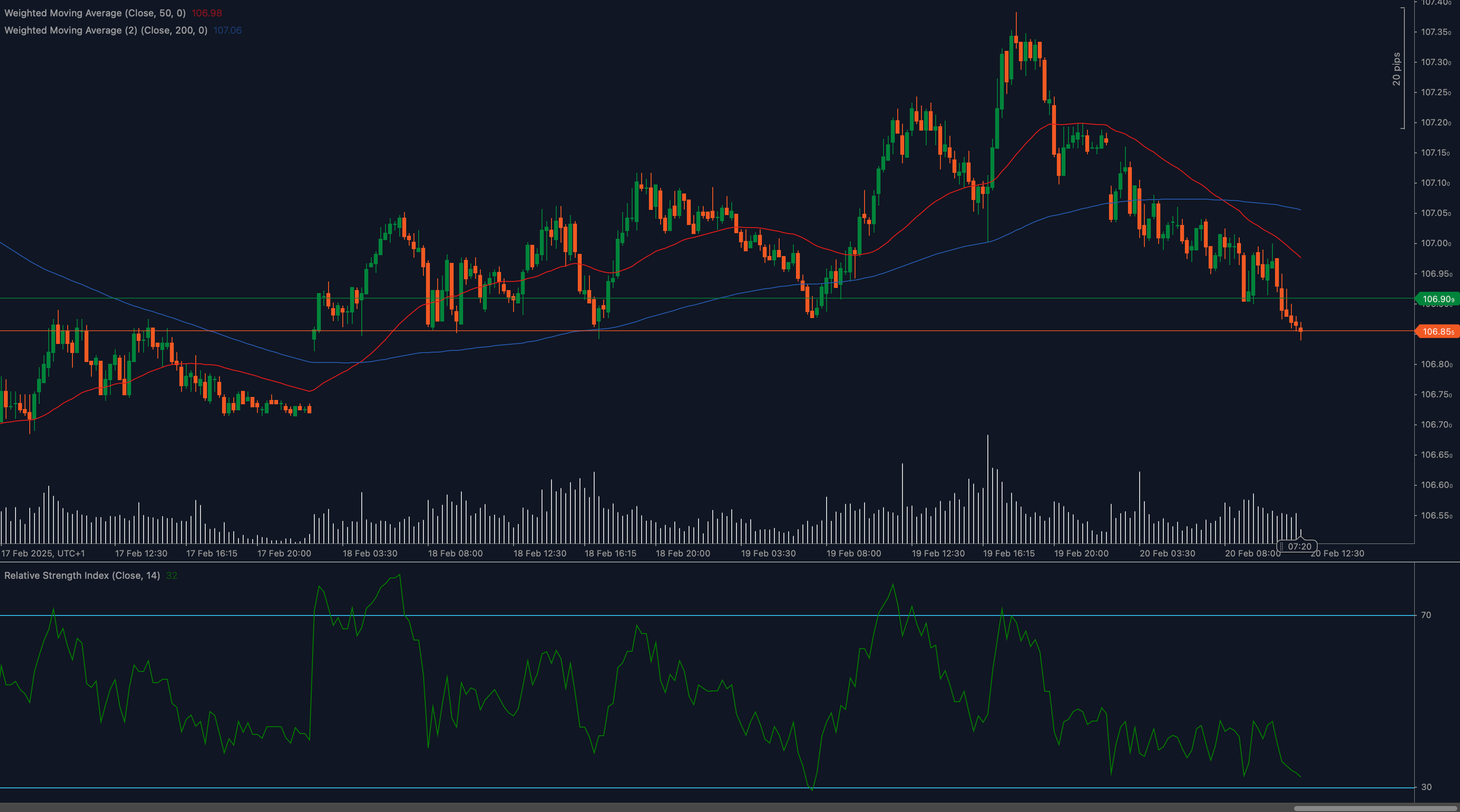

The US Dollar Index (DXY) is currently testing a critical support level at 106.85, with resistance at 106.90. The index has been under selling pressure, and traders are closely watching for a potential breakdown or rebound. This analysis examines key technical levels, indicators, and fundamental drivers shaping the next move in DXY.

Technical Analysis

📌 Support & Resistance:

- Support: 106.85 – A breakdown here could accelerate losses toward 106.50.

- Resistance: 106.90 – A move above this level could see a retest of 107.20.

📌 Moving Averages (MAs):

- 50 Weighted Moving Average (WMA) at 106.98 – Price is trading below this key level, reinforcing bearish sentiment.

- 200 WMA at 107.06 – Further resistance sits slightly above, adding pressure on any potential recovery.

📌 Relative Strength Index (RSI):

- Currently at 32, signaling that DXY is approaching oversold territory.

- Bullish Signal: A move above 40 RSI could indicate growing buying interest.

- Bearish Signal: A drop below 30 RSI would confirm deeper bearish momentum.

Fundamental Factors Affecting DXY

🔹 US Economic Data & Federal Reserve Policy

- Upcoming inflation data, non-farm payrolls, and GDP growth reports will drive USD sentiment.

- Speculation around the Federal Reserve’s next rate decision remains a key driver. Any hints of policy tightening could support the dollar.

🔹 Global Market Sentiment

- Risk-on or risk-off environment? A surge in risk appetite could weaken the USD as investors move into equities and riskier assets.

- Geopolitical risks – Any escalation in global conflicts may boost demand for the dollar as a safe-haven asset.

🔹 Yield Spreads & Bond Market Movements

- US Treasury yields are crucial for DXY’s strength. If yields rise, USD could see renewed demand, while falling yields may weigh on the index.

Outlook & Trading Considerations

✅ Bullish Scenario:

- A breakout above 106.90, confirmed by RSI moving above 40, could push DXY towards 107.20 and possibly 107.50.

- Strong economic data and hawkish Fed comments could drive further upside.

❌ Bearish Scenario:

- A failure to hold 106.85 support, along with an RSI drop below 30, would signal further downside.

- Bearish momentum could lead to a test of 106.50, with 106.00 as the next major support.

🎯 Trading Strategy:

- Aggressive traders may look for long entries on a confirmed breakout above 106.90, with stops below support.

- Short sellers can target breakdowns below 106.85, aiming for 106.50 as the next support.

- Volume confirmation is crucial – any breakout or breakdown should be supported by strong volume to validate the move.

🔔 Final Thoughts

DXY is at a pivotal level, and upcoming economic reports will play a major role in its next move. Traders should stay cautious, wait for confirmation, and manage risk accordingly.

📢 Stay updated with real-time market analysis:

👉 https://vantofx.com/tools/news-and-analysis/