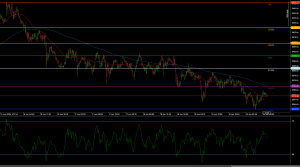

EUR/GBP Technical Analysis: Range Holds Near 78.6% Fib at 0.8520

EUR/GBP is holding within a tight consolidation near 0.8520 — the 78.6% Fibonacci retracement of the June rebound. Momentum remains neutral with RSI around midline and price action respecting range extremes. Bulls must reclaim 0.8540 to shift momentum; below 0.8512