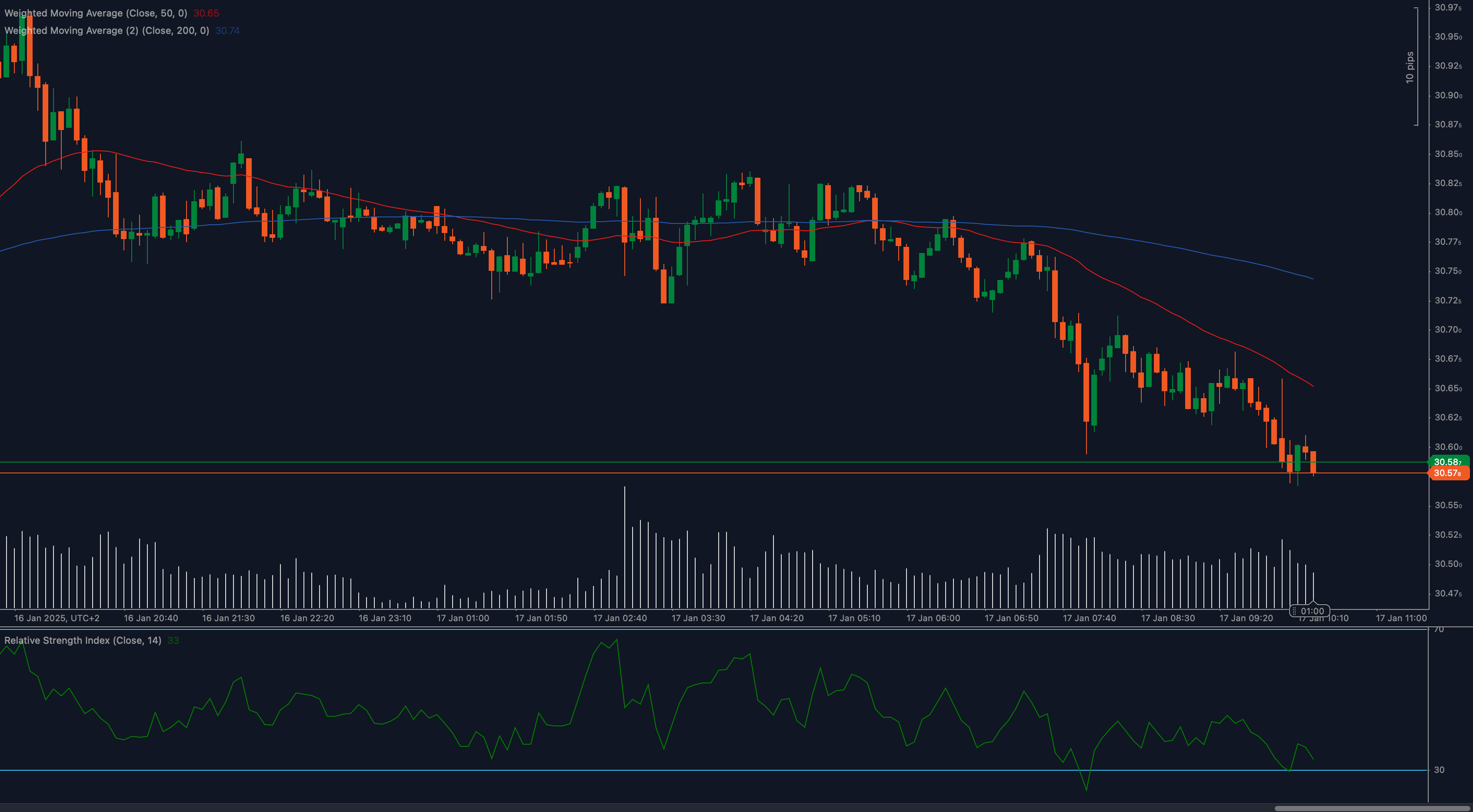

Silver (XAG/USD) is testing a critical 30.57 support level, where bulls are trying to defend against increasing selling pressure. The pair has been on a consistent downtrend, and this level represents a major test for the ongoing momentum.

📉 Moving averages highlight a bearish trend. The price remains below both the 50 Weighted Moving Average (WMA) and 200 WMA, which are acting as strong resistance zones. The downward slope of these moving averages reinforces the bearish outlook. If the price fails to hold above 30.57, the next downside target lies near 30.30, a level that aligns with previous demand zones.

📊 RSI shows slowing bearish momentum. The Relative Strength Index (RSI) is currently around 33, indicating oversold conditions are approaching. While this suggests that selling pressure may be weakening, a clear recovery above 40 would signal that buyers are regaining some control. If RSI drops further, expect additional downside.

🔎 Key levels to watch:

- Support: 30.57 (current level), 30.30 (next major support)

- Resistance: 30.65 (short-term), 30.85 (50 WMA)

💡 Fundamentals remain a key driver. Silver prices are under pressure due to a strengthening US Dollar (DXY) and rising Treasury yields, which reduce the appeal of non-yielding assets like silver. However, safe-haven demand could rise if broader market uncertainty increases, providing some relief for silver prices.

🌍 The 30.57 level is critical. If buyers manage to defend this level, we could see a recovery attempt toward 30.65 and possibly higher. On the other hand, a breakdown below this support could pave the way for a decline toward 30.30 or lower. Let’s see how the price action develops!