The US dollar gained momentum following the University of Michigan (UoM) Inflation Expectations survey, which showed a jump in the proportion of consumers anticipating price increases over the next year—from 3.3% to 4.3%. This development is concerning because higher inflation expectations can become self-fulfilling if workers demand wage increases in anticipation of rising costs. These elevated expectations arrive on the heels of January’s labor market data, which revealed a stronger-than-anticipated 0.5% month-over-month rise in wages.

Although traders had recently been lowering their outlook on US interest rates, the combination of solid wage growth, heightened inflation expectations, and the prospect of inflationary measures under Donald Trump suggests the Federal Reserve may stay on hold for quite some time. As a result, yields are creeping higher again, while stock indices and gold have weakened, and the dollar has strengthened broadly. Looking ahead, upcoming US CPI data, Federal Reserve Chair Jerome Powell’s testimony, and corporate earnings reports will be in the spotlight. In this environment, the dollar’s outlook appears bullish.

Friday’s Data: Fed Rate Cuts Appear Unlikely

Friday’s releases have likely reduced the already small possibility of a Fed rate cut in the near term. Despite a slightly lower headline reading for non-farm payrolls, the overall labor market continues to show resilience, and wage pressures remain elevated—leaving the Fed with little reason to relax monetary policy. Moreover, Friday’s UoM survey drew even more attention by highlighting inflation concerns. With the Trump administration’s fiscal and trade policies set to influence both employment and pricing, standing pat on rates seems prudent for now, reinforcing a positive bias for the US dollar. This is particularly true against currencies that remain vulnerable to potential US tariffs.

Although the preliminary reading for UoM Consumer Sentiment (67.8 versus 71.9 expected) was softer, it was overshadowed by the jump in inflation expectations from 3.3% to 4.3%. This signals that consumers anticipate inflation to pick up under Trump’s leadership.

Labor Market Update

January’s non-farm payrolls data was mixed but still supportive of the greenback. Most notable was the 0.5% increase in average earnings on a month-over-month basis, pushing the year-over-year wage growth to 4.1% from 3.9%. Such robust wage gains point to mounting price pressures, making immediate rate cuts unlikely—even as the administration calls for cheaper borrowing.

The payrolls headline figure missed forecasts at 143K, but revisions to prior months added a combined total of 100K jobs, mitigating any disappointment. Meanwhile, the unemployment rate dipped to 4.0% from 4.1% in the previous period.

Key Events Next Week: Powell Testimony, CPI, and Retail Sales

Powell’s Testimony (Tuesday, February 11 at 15:00 GMT)

Following President Trump’s push for lower interest rates, Fed Chair Jerome Powell is likely to emphasize the central bank’s independence. With wage growth and inflation expectations already flashing signs of pressure, it would be difficult for Powell to justify rate cuts. Nonetheless, if he hints at any shift toward easier policy, both the dollar and bond yields could slide. Powell will continue his testimony on Wednesday.

US CPI (Wednesday, February 12 at 13:30 GMT)

Investors will be closely monitoring the US Consumer Price Index for fresh clues on inflation trends. If CPI data shows more upward pressure, the market is likely to further reduce expectations for a Fed rate cut, boosting both the dollar and Treasury yields. The Producer Price Index (PPI) due out on Thursday at the same time could provide additional insight into inflationary pressures.

US Retail Sales (Friday, February 14 at 13:30 GMT)

Despite concerns that higher interest rates or rising prices could erode consumer purchasing power, retail sales have remained relatively steady. However, December’s figures were slightly softer at 0.4% month-over-month, compared to a 0.6% forecast. Whether this was an isolated dip or the start of a trend remains to be seen. Concurrently, earnings results from tech giants and major retailers will offer a deeper look into the health of consumer spending.

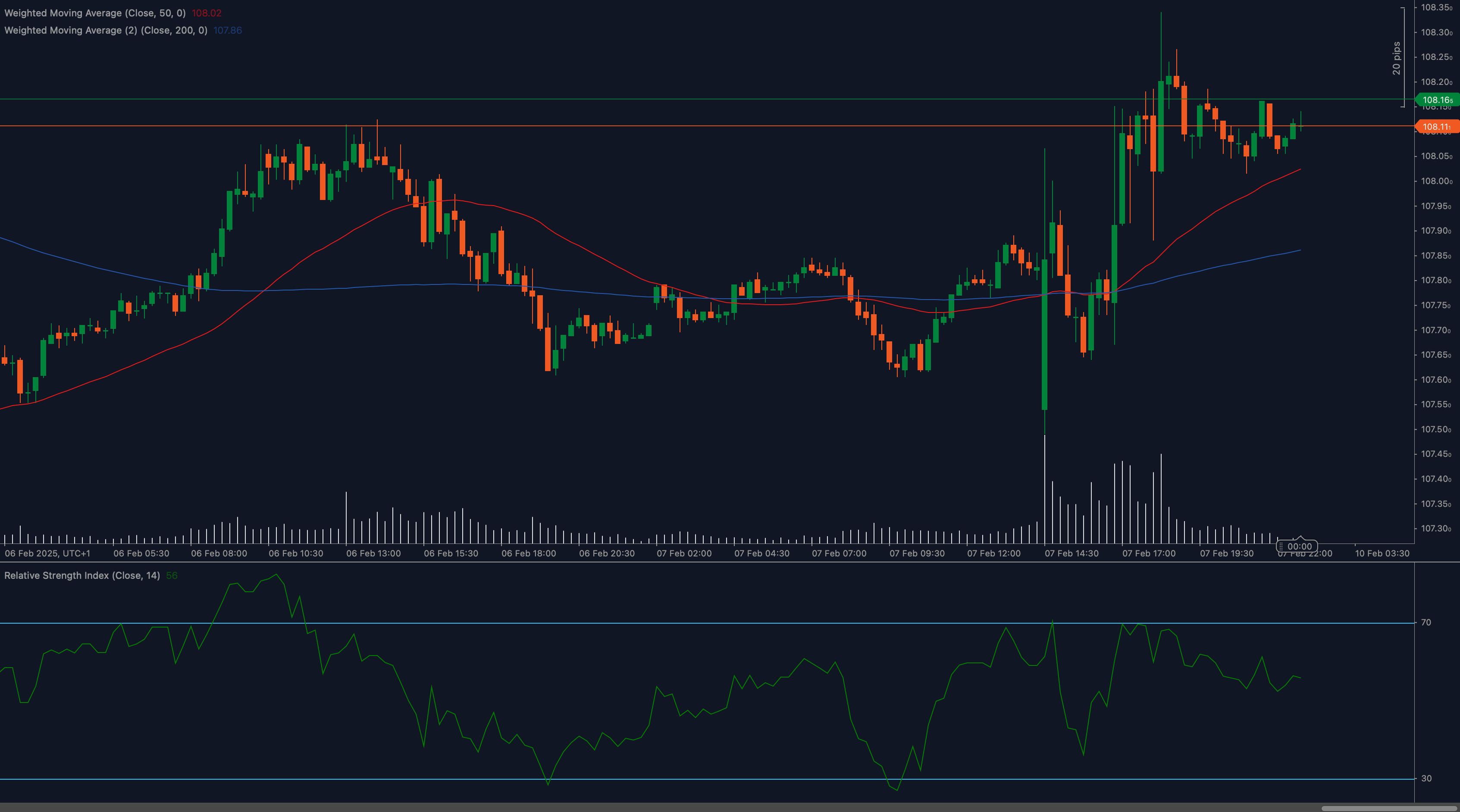

The U.S. Dollar Index (DXY) has reached 108.16 resistance, gaining momentum after a strong recovery. Buyers remain in control, but a breakout confirmation is needed for further upside.

Technical Analysis

📉 Weighted Moving Averages Confirm Bullish Structure

The 50 Weighted Moving Average (WMA) at 108.02 remains above the 200 WMA at 107.86, reinforcing a bullish bias. A sustained move above these levels would support further gains.

📊 RSI Shows Strengthening Momentum

The Relative Strength Index (RSI) is at 56, indicating improving sentiment. A push above 60 RSI could signal further upside, while a drop below 50 RSI may suggest fading momentum.

🔎 Resistance and Support Levels in Focus

DXY is testing a key resistance level, with traders watching for a breakout or potential rejection.

Key Levels to Watch

Support Levels:

- 108.00: Immediate support, keeping the bullish structure intact.

- 107.80: Stronger support near the 200 WMA.

Resistance Levels:

- 108.16: Immediate resistance limiting further upside.

- 108.30: Next key level if the breakout is confirmed.

Fundamental Drivers

DXY remains influenced by U.S. economic data, Federal Reserve rate expectations, and global risk sentiment. Traders are closely watching upcoming inflation reports and central bank commentary for further direction.

Outlook

A confirmed breakout above 108.16 could push DXY toward 108.30, while failure to hold gains may lead to a retest of 108.00 or lower.

Traders should monitor price action and macroeconomic developments for confirmation of the next move.