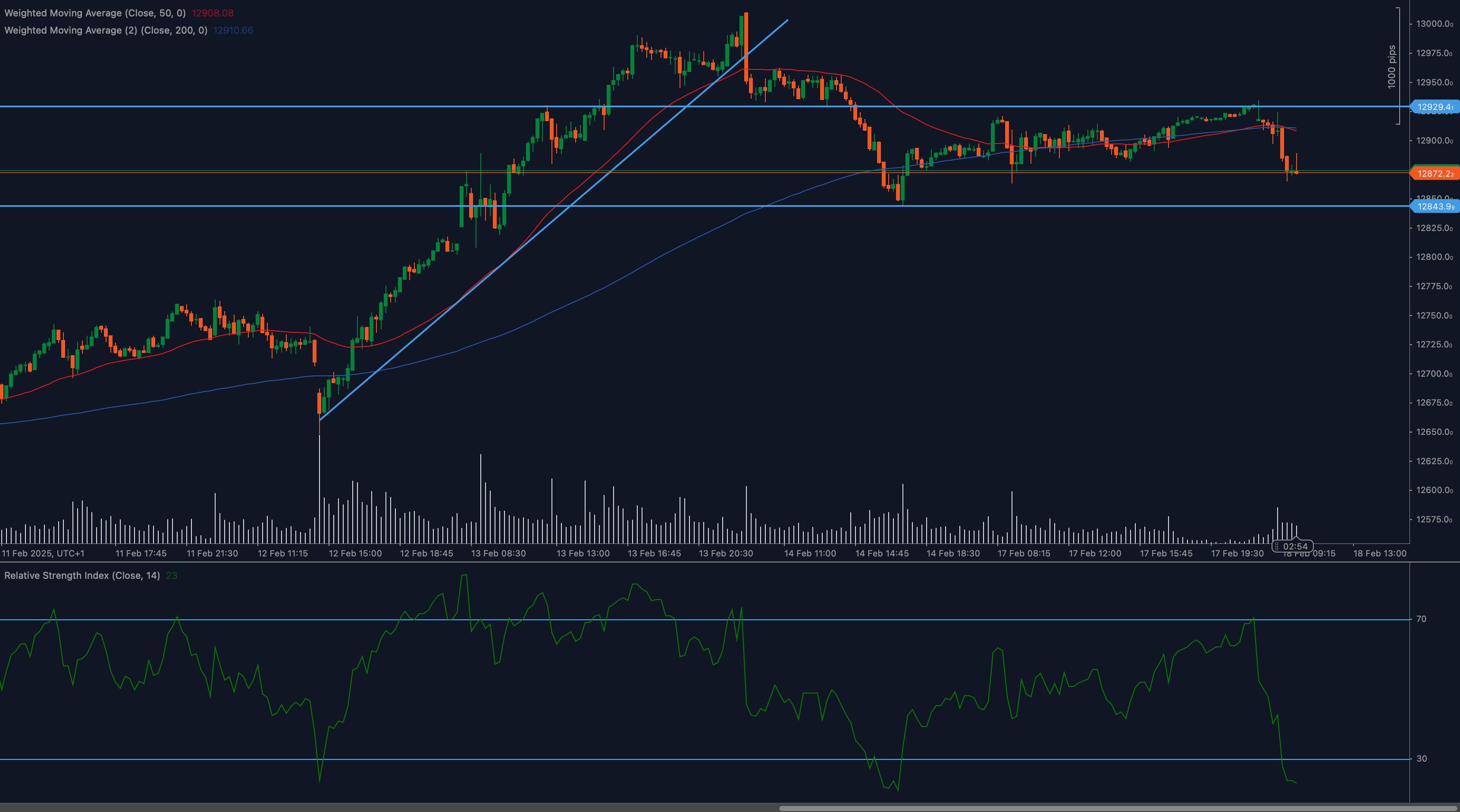

The Swiss Market Index (SMI20) has entered a correction phase after failing to hold above 12,900 resistance. The index is now testing 12,872 support, with sellers in control following a steep decline. With RSI dropping sharply, downside momentum is increasing, making this a critical juncture for the market. This analysis explores the technical indicators, key levels, and fundamental factors shaping the next potential move.

📊 Detailed Technical Analysis

✅ Break of Uptrend SMI20 initially surged in an upward trajectory but lost steam at 12,900 resistance, triggering a sell-off

📉 Moving Averages (MAs)

50 WMA at 12,908 The price has fallen below this level, signaling a shift in momentum

200 WMA at 12,910 A further drop could confirm deeper bearish pressure

📊 Relative Strength Index (RSI)

Current RSI 23 ⏬ (Oversold Territory)

Bullish Signal If RSI recovers above 30, a relief bounce is possible

Bearish Signal A continued drop could signal more selling pressure

📍 Key Support and Resistance Levels

🔻 Support Levels

12,872 Immediate support level currently being tested

12,843 Lower key support if selling accelerates

🔺 Resistance Levels

12,900 If reclaimed, could indicate renewed bullish strength

12,950 Major resistance level for potential recovery

🌍 Fundamental Factors Influencing SMI20

📉 Global Stock Market Performance The SMI often follows broader European and global market trends

🏦 Swiss Economic Outlook Economic data, SNB policies, and corporate earnings reports influence market sentiment

💰 Interest Rate Speculation Any signals from the Swiss National Bank (SNB) regarding monetary policy shifts could impact SMI20

📉 Market Risk Appetite Global risk sentiment, particularly from the U.S. and Eurozone, will play a role in shaping market direction

🔮 Outlook and Trading Considerations

📈 Bullish Scenario If SMI20 holds 12,872 support and RSI rebounds above 30, a recovery toward 12,900 – 12,950 is possible

📉 Bearish Scenario A failure to hold 12,872 could trigger a move toward 12,843 or lower, confirming a deeper correction

💡 Trading Recommendation

Aggressive Traders Might consider small long positions if price stabilizes above 12,872, with stops below

Conservative Traders Should wait for confirmation (a breakout or a confirmed bounce) before entering trades

Short Sellers A breakdown below 12,872 could provide an opportunity to target 12,843, with stops above resistance

⚠ Volume is Key Watch for high volume confirming either a breakout or breakdown

📌 Disclaimer This analysis is for informational purposes only. Trading involves risks, and past performance does not guarantee future results. Always conduct independent research before making financial decisions