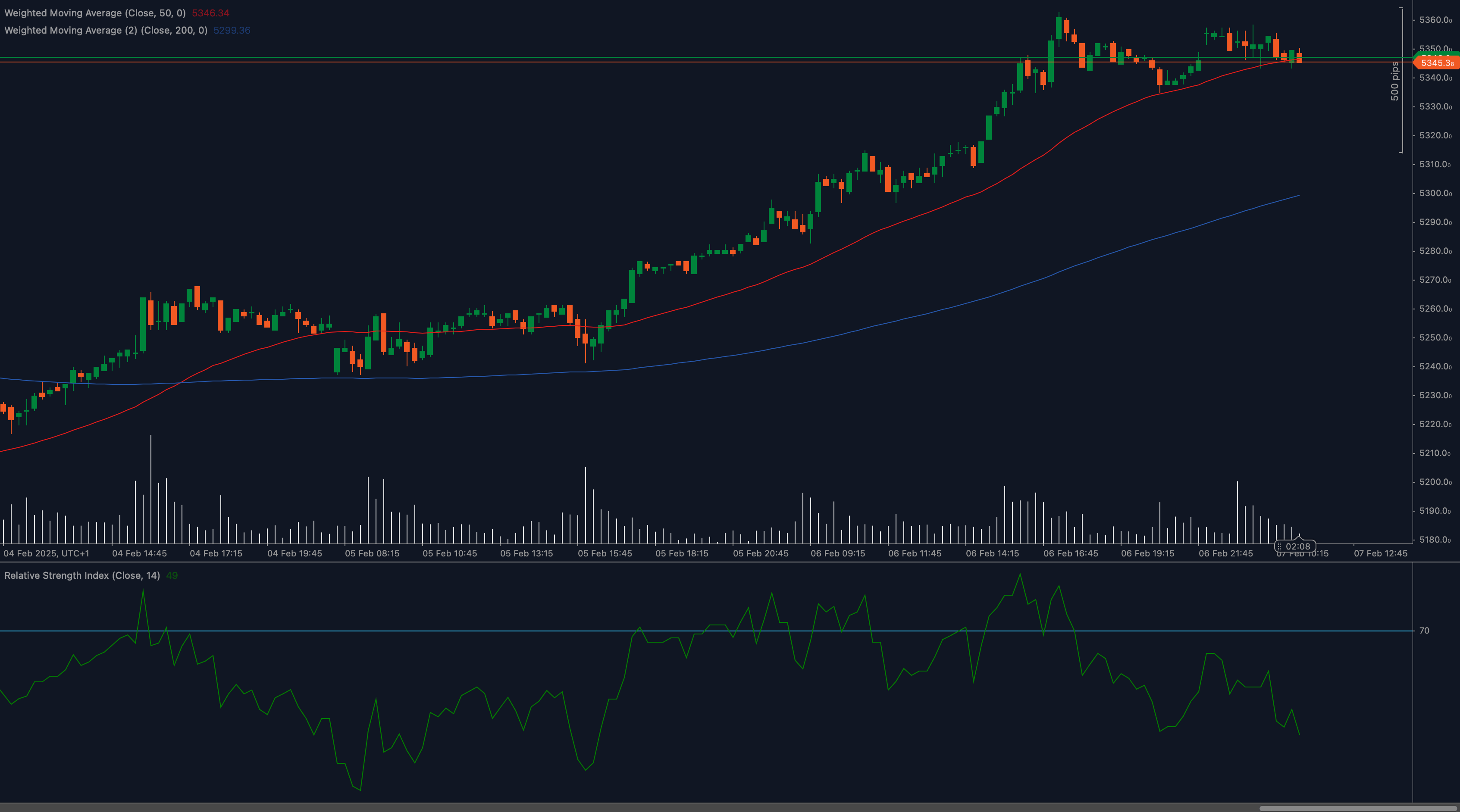

The Euro Stoxx 50 (ESX50) has reached a key resistance level at 5,345, pausing after a strong bullish run. Buyers are attempting to sustain momentum, but price action suggests possible hesitation.

Technical Analysis

📉 Weighted Moving Averages Confirm Bullish Trend

The 50 Weighted Moving Average (WMA) at 5,346 is above the 200 WMA at 5,299, keeping the broader uptrend intact. However, a loss of upside momentum could trigger a pullback.

📊 RSI Signals Slowing Momentum

The Relative Strength Index (RSI) is at 49, indicating neutral momentum. If RSI falls below 45, selling pressure could increase, while a move above 55 RSI might support further gains.

🔎 Key Resistance and Support Levels to Watch

With ESX50 consolidating near resistance, traders are watching for a breakout or rejection at these levels.

Key Levels to Watch

Support Levels:

- 5,330: Immediate support where buyers may attempt to stabilize.

- 5,300: Stronger support near the 200 WMA.

Resistance Levels:

- 5,345: Immediate resistance limiting further upside.

- 5,370: Next target if bullish momentum resumes.

Fundamental Drivers

The Euro Stoxx 50 remains influenced by European economic data, earnings reports, and global equity sentiment. Investors are closely watching ECB policy signals and macroeconomic developments for further direction.

Outlook

ESX50’s ability to stay above 5,330 will determine its next move. A breakout above 5,345 could push the index toward 5,370, while a drop below this level may lead to a correction toward 5,300.

Traders should monitor market sentiment and upcoming economic data to gauge the next trend direction.