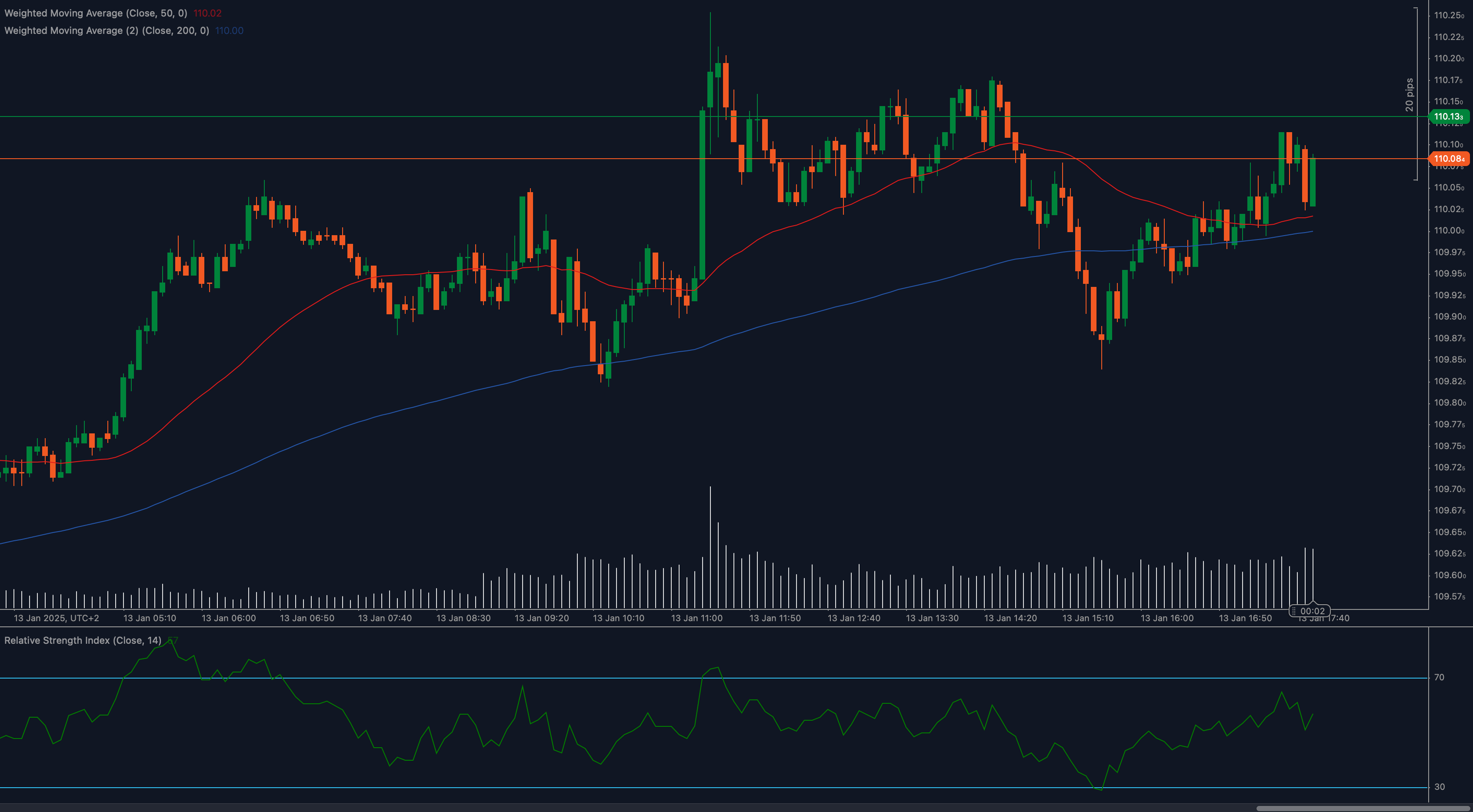

The US Dollar Index (DXY) is testing a major 110.13 resistance level, as bullish momentum builds. Buyers are stepping in, supported by moving averages, but will the Dollar break out, or is a rejection coming?

📈 Moving averages provide strong support. The 50 Weighted Moving Average (WMA) and 200 WMA are both trending upward, creating a solid foundation for the current rally. If DXY holds above these levels, we could see a breakout beyond 110.13, with the next upside target at 110.30.

📊 RSI suggests growing momentum. The Relative Strength Index (RSI) is hovering near 60, which indicates bullish strength. However, it is not yet overbought, meaning there could still be room for further upside before a correction. If RSI moves above 70, we may see profit-taking.

💡 Key levels to watch:

- Support: 110.00 (psychological), 109.85 (WMA support)

- Resistance: 110.13 (current), 110.30 (next breakout target)

⚠️ Fundamental drivers are in focus. The US Dollar remains strong as Treasury yields rise and the Federal Reserve maintains a hawkish tone. Any shift in Fed policy or surprise economic data could impact DXY’s direction. If risk sentiment improves, we may see some weakness in the Dollar, but for now, buyers remain in control.

🌍 The 110.13 resistance zone is a major test—a breakout could push DXY toward 110.30, while rejection might send it back toward 110.00. Let’s see if bulls can maintain control!