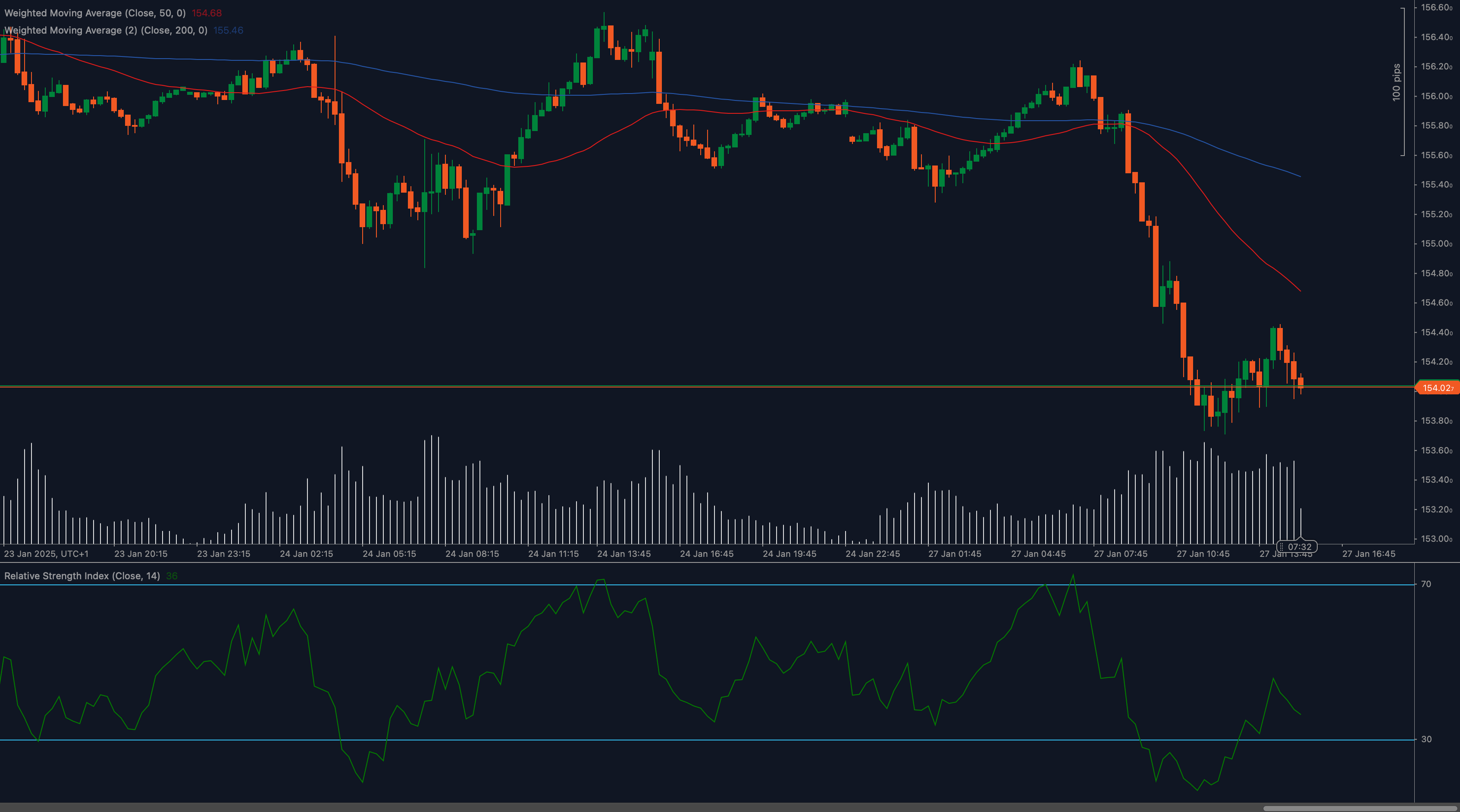

USD/JPY has broken below the critical 154.00 support level, marking a continuation of its bearish trajectory. Market sentiment has turned cautious as traders assess whether the pair can regain footing above this key level or extend losses further.

Technical Analysis

📈 Weighted Moving Averages Show Bearish Pressure

The 50 Weighted Moving Average (WMA) at 154.68 remains firmly below the 200 WMA at 155.46, reinforcing a bearish outlook. With the pair trading below both averages, downward pressure continues to dominate.

📊 RSI Signals Weak Momentum

The Relative Strength Index (RSI) has dropped to 36, suggesting bearish momentum is still strong but approaching oversold conditions. A bounce from oversold territory could indicate short-term recovery potential.

🔎 Key Levels Highlight Crucial Zones

The breach of the 154.00 support now turns attention to the next support level at 153.50, while immediate resistance is seen at 154.68.

Key Levels to Watch

Support Levels:

- 154.00: Psychological and technical support recently broken.

- 153.50: Next major support zone.

Resistance Levels:

- 154.68: Resistance tied to the 50 WMA.

- 155.46: Strong resistance at the 200 WMA.

Fundamental Drivers

The USD/JPY pair is under pressure amid renewed risk-off sentiment and shifting expectations for monetary policy in both the US and Japan. The US dollar has faced selling pressure due to weaker economic data, while speculation about potential adjustments to the Bank of Japan’s ultra-loose policy has bolstered the yen. Upcoming releases, including US inflation data and the Federal Reserve’s meeting minutes, will likely dictate further moves.

Outlook

USD/JPY’s break below 154.00 underscores persistent bearish sentiment. A sustained move below this level could open the door to further declines toward 153.50. Conversely, a recovery above 154.68 might offer short-term relief for bulls.