📊 MARKET OVERVIEW

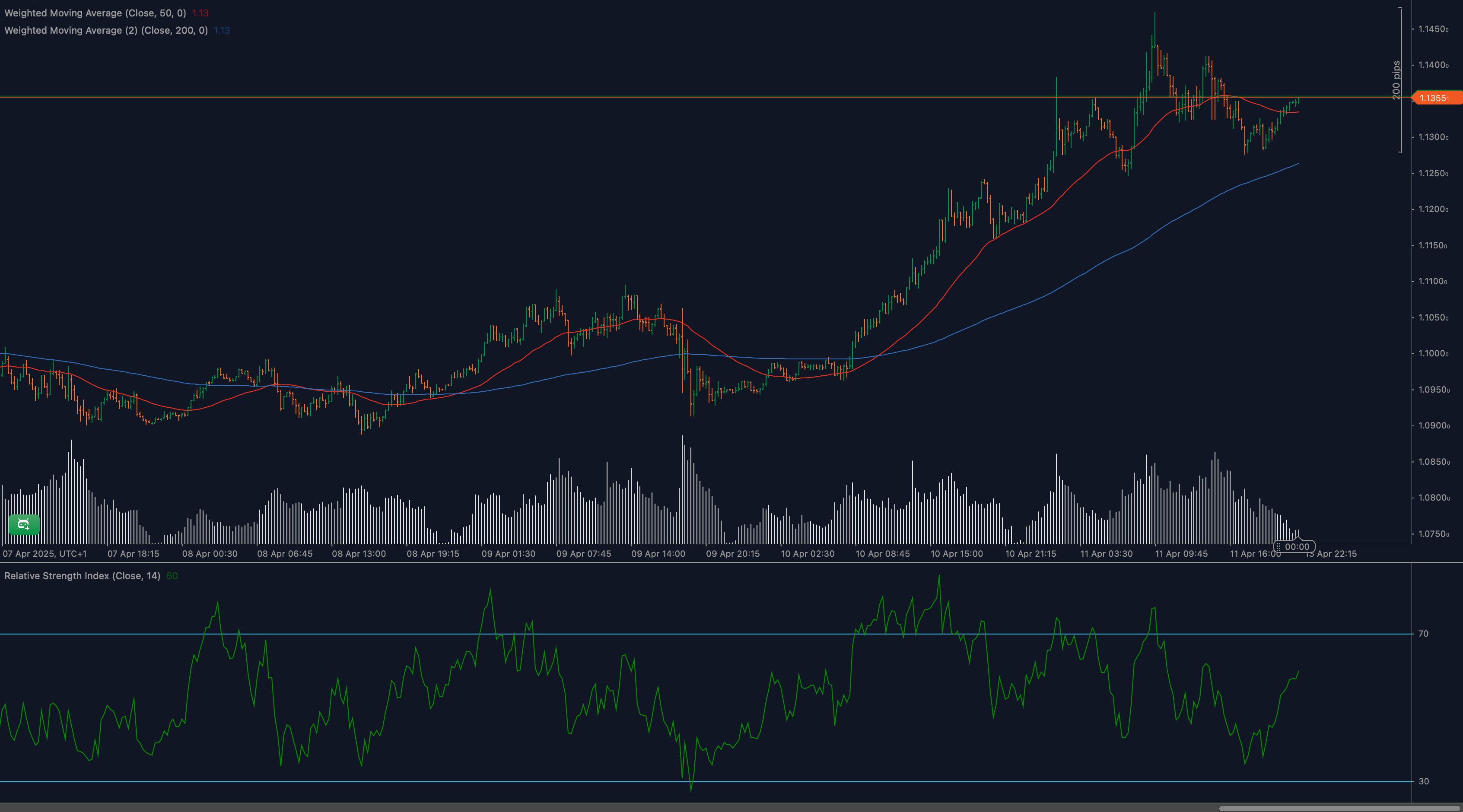

EUR/USD continues to engage closely with the crucial resistance level at 1.1355, following substantial bullish momentum. The recent price action highlights a repeated struggle at this technical level, reinforcing its significance. Weighted moving averages and the Relative Strength Index (RSI) remain supportive of bullish sentiment, suggesting potential for further upside should the pair manage to secure a sustained breakout.

Traders are keenly monitoring this area for signals of either a bullish continuation or potential bearish reversal. Given the importance of current technical setups, a detailed exploration of key indicators like moving averages, RSI momentum, price action patterns, and Fibonacci retracement levels will provide greater clarity on possible near-term market directions.

📈 TECHNICAL ANALYSIS

What Are the Key Support and Resistance Levels for EUR/USD?

Resistance at 1.1355 remains firmly in place as the major barrier to bullish advancement. Above this, psychological resistance at 1.1400 becomes a natural target for traders eyeing upward momentum. On the downside, immediate support is seen near 1.1300, followed closely by dynamic support from the 50-period moving average around 1.1275. Further below, key psychological and historical support at 1.1250 offers significant cushioning against any extended bearish pressure.

Moving Average Analysis and Dynamic Price Levels

EUR/USD currently trades above its 50-period and 200-period weighted moving averages (WMA), reinforcing the bullish bias observed recently. The 50-WMA, positioned around 1.1275, provides dynamic support for short-term pullbacks, while the longer-term 200-WMA suggests sustained bullish sentiment. Traders should remain alert to potential interactions between these moving averages, as any crossover or sharp price reaction could signal upcoming trend shifts.

RSI Momentum Analysis and Divergence Patterns

The RSI on the 14-period currently reads approximately 60, indicating strong but manageable bullish momentum without signaling immediate overbought conditions. Notably, the RSI has remained supportive of recent price gains. However, vigilance for potential divergence patterns remains essential. Any failure of RSI to confirm new highs if price breaks above resistance at 1.1355 could suggest weakening momentum, hinting at possible corrective movements.

Price Action and Candlestick Analysis

Recent candlesticks demonstrate clear indecision around the resistance level at 1.1355, represented by small-bodied candles with pronounced wicks indicating both buying and selling pressure. Nonetheless, the dominant presence of bullish candles underscores a continued bias towards upward price movements. Traders should look for clear bullish engulfing or strong bearish reversal patterns at this resistance level to confirm the direction of EUR/USD’s next significant move.

Chart Patterns and Formation Analysis

An ascending triangle pattern remains visible on the EUR/USD chart, defined by the horizontal resistance at 1.1355 and an upward-sloping support line from recent lows. Typically, such patterns signify bullish continuation, and a confirmed breakout above 1.1355 would likely accelerate the upward move towards targets near 1.1400 and potentially higher. Conversely, a clear break below ascending support could suggest bearish tendencies returning to the market.

Fibonacci Retracement Levels and Extension Targets

Fibonacci retracements from recent bullish swings indicate key support areas at 38.2% (around 1.1280), 50% (near 1.1250), and 61.8% (approximately 1.1225). During corrections, these levels should be closely observed. If a bullish breakout occurs above 1.1355, Fibonacci extension targets at 127.2% (around 1.1400) and 161.8% (approximately 1.1450) become viable upside objectives.

🔍 MARKET OUTLOOK & TRADING SCENARIOS

Bullish Scenario for EUR/USD

A confirmed bullish breakout above 1.1355 would strongly validate further upward movement towards initial targets at 1.1400, potentially extending to 1.1450. Supporting indicators like the RSI and positive moving averages reinforce this scenario, suggesting favorable trading setups upon breakout confirmation.

Neutral Scenario for EUR/USD

If EUR/USD remains range-bound between resistance at 1.1355 and immediate support around 1.1300, it provides opportunities for short-term scalping. Traders focusing on neutral scenarios should maintain strict risk management, particularly as the market awaits stronger directional signals.

Bearish Scenario for EUR/USD

Should EUR/USD fail again at resistance at 1.1355 and subsequently breach below the 1.1300 support level, bearish sentiment would likely increase significantly. Such movements could target deeper supports near the 50-WMA at 1.1275 and potentially lower Fibonacci retracement levels around 1.1250 and 1.1225.

💼 TRADING CONSIDERATIONS

Effective trading strategies for EUR/USD currently involve close monitoring of breakout signals above 1.1355 or bearish rejections at this level. Traders should employ tight stop-losses around these critical levels to manage risk effectively, taking partial profits at key Fibonacci and moving average support/resistance points. Discipline and vigilance in managing market entry and exit are essential to capitalize on the unfolding EUR/USD trading opportunities.

🏁 CONCLUSION

EUR/USD continues its critical test of resistance at 1.1355, supported by bullish moving averages and favorable RSI momentum. Traders should remain attentive to potential breakout confirmations or rejection patterns around this pivotal area. Strategic planning and precise execution based on clear technical signals remain crucial for successful trading outcomes.

⚠️ DISCLAIMER

This analysis is for informational purposes only and should not be considered financial advice. Forex trading involves significant risk. Always consult a professional advisor before entering trades.