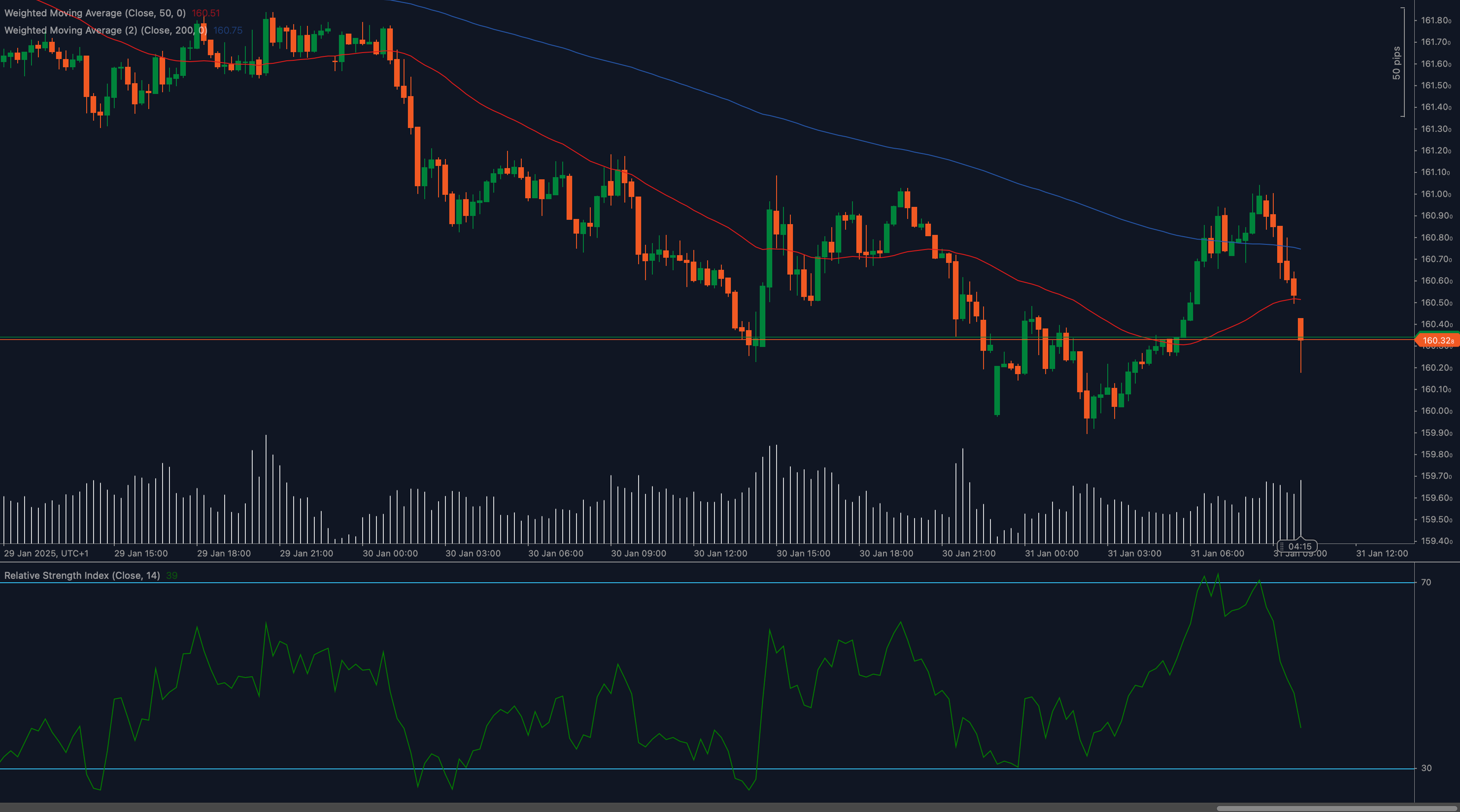

EUR/JPY has reversed lower after failing to sustain gains above 161.00, retreating to the 160.30 support level. The pair is showing increasing downside pressure as sellers take control following the rejection at higher levels.

Technical Analysis

📉 Weighted Moving Averages Indicate Renewed Bearish Pressure

The 50 Weighted Moving Average (WMA) at 160.51 is still below the 200 WMA at 160.75, reinforcing a bearish outlook. The pair’s inability to hold above these levels has added to the downside momentum.

📊 RSI Signals Weakening Bullish Momentum

The Relative Strength Index (RSI) has dropped to 39, reflecting weakening bullish momentum. A continued decline below 35 RSI would suggest growing selling pressure.

🔎 Key Levels to Watch for the Next Move

EUR/JPY is now hovering near 160.30 support. If this level holds, buyers may attempt a rebound, while a break lower could trigger a deeper decline.

Key Levels to Watch

Support Levels:

- 160.30: Immediate support where buyers may attempt to stabilize.

- 159.80: Stronger support in case selling pressure intensifies.

Resistance Levels:

- 160.75: Resistance aligned with the 200 WMA.

- 161.00: Key barrier where sellers took control.

Fundamental Drivers

EUR/JPY is being influenced by monetary policy expectations and risk sentiment. The euro faces pressure as markets reassess ECB rate expectations, while the yen gains amid global risk aversion. Upcoming Eurozone inflation data and Bank of Japan commentary could provide further direction.

Outlook

EUR/JPY is at a pivotal level near 160.30. A rebound could see the pair reattempt 160.75 and 161.00, while continued selling pressure may expose 159.80 as the next target.

Traders should monitor price action at key support levels and keep an eye on upcoming macroeconomic events for further clues.