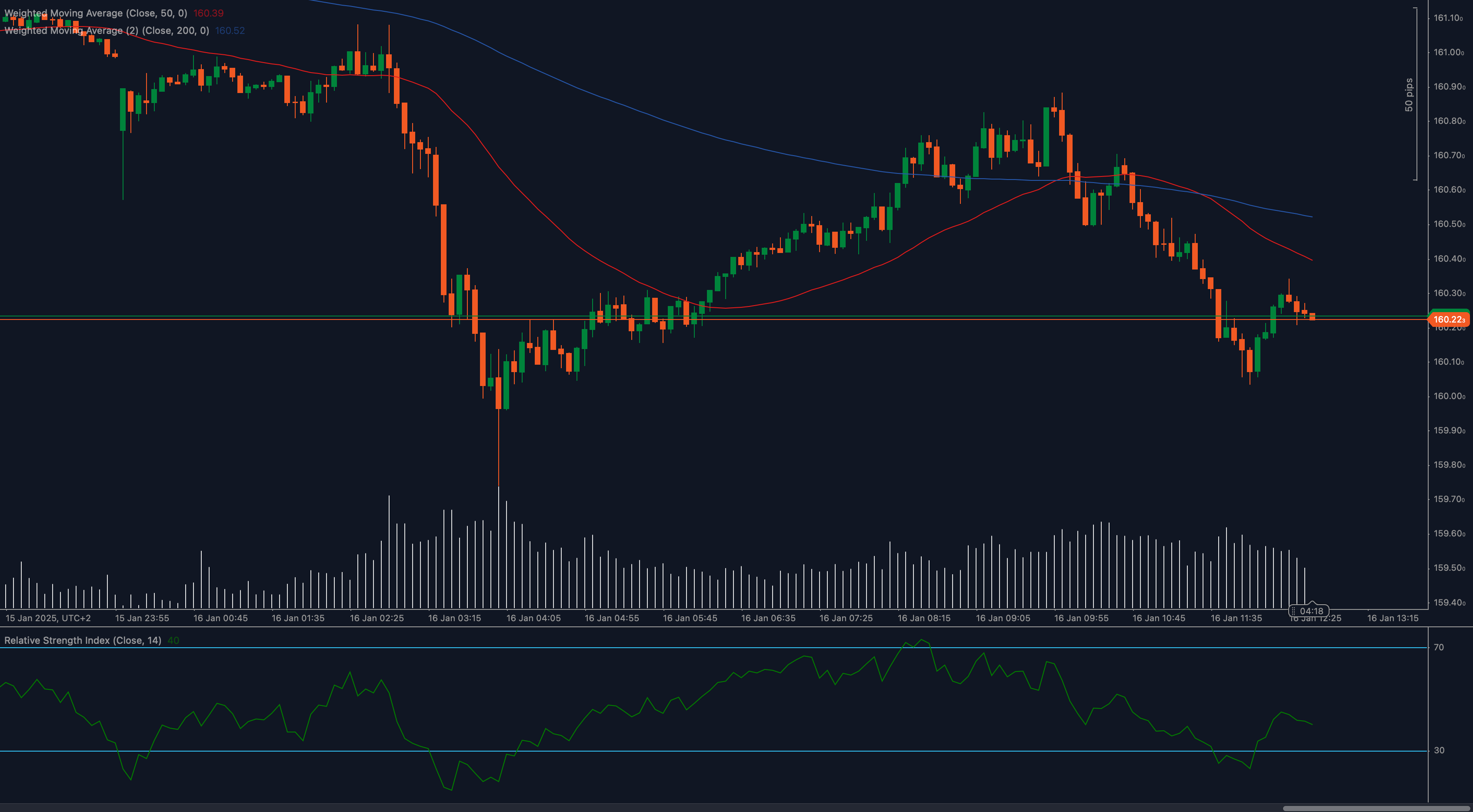

The EUR/JPY pair is testing the key 160.22 support level, a critical area that could define the next directional move. Sellers are keeping pressure on the pair, but buyers have managed to defend this level so far. The question is whether the pair will bounce higher or break lower toward the next support zone.

📉 Moving averages are weighing on the price. The 50 Weighted Moving Average (WMA) and the 200 WMA are both positioned above the current price, acting as resistance. The downward slope of the 50 WMA indicates that bearish momentum is still present. A sustained move below 160.22 could open the door to further losses, with the next target near 159.80.

📊 RSI shows slowing momentum. The Relative Strength Index (RSI) is currently hovering near 40, suggesting that selling pressure may be losing steam. However, the RSI has not yet recovered above 50, which means buyers need to push harder to regain control. If RSI moves lower, it would signal increased bearish momentum.

💡 Key levels to watch:

- Support: 160.22 (current level), 159.80 (next target)

- Resistance: 160.50 (minor), 160.90 (major level, near 50 WMA)

🔎 Fundamentals could shape the next move. The recent weakness in EUR/JPY is tied to concerns about slower Eurozone growth and increased demand for the safe-haven Japanese Yen amid global economic uncertainty. Additionally, market participants are watching European Central Bank (ECB) and Bank of Japan (BoJ) commentary for clues on monetary policy direction.

🌍 160.22 is the line in the sand. A breakdown could send EUR/JPY toward 159.80, while a bounce above 160.50 might bring the pair closer to the 160.90 resistance zone. Let’s keep an eye on momentum and price action for clues!