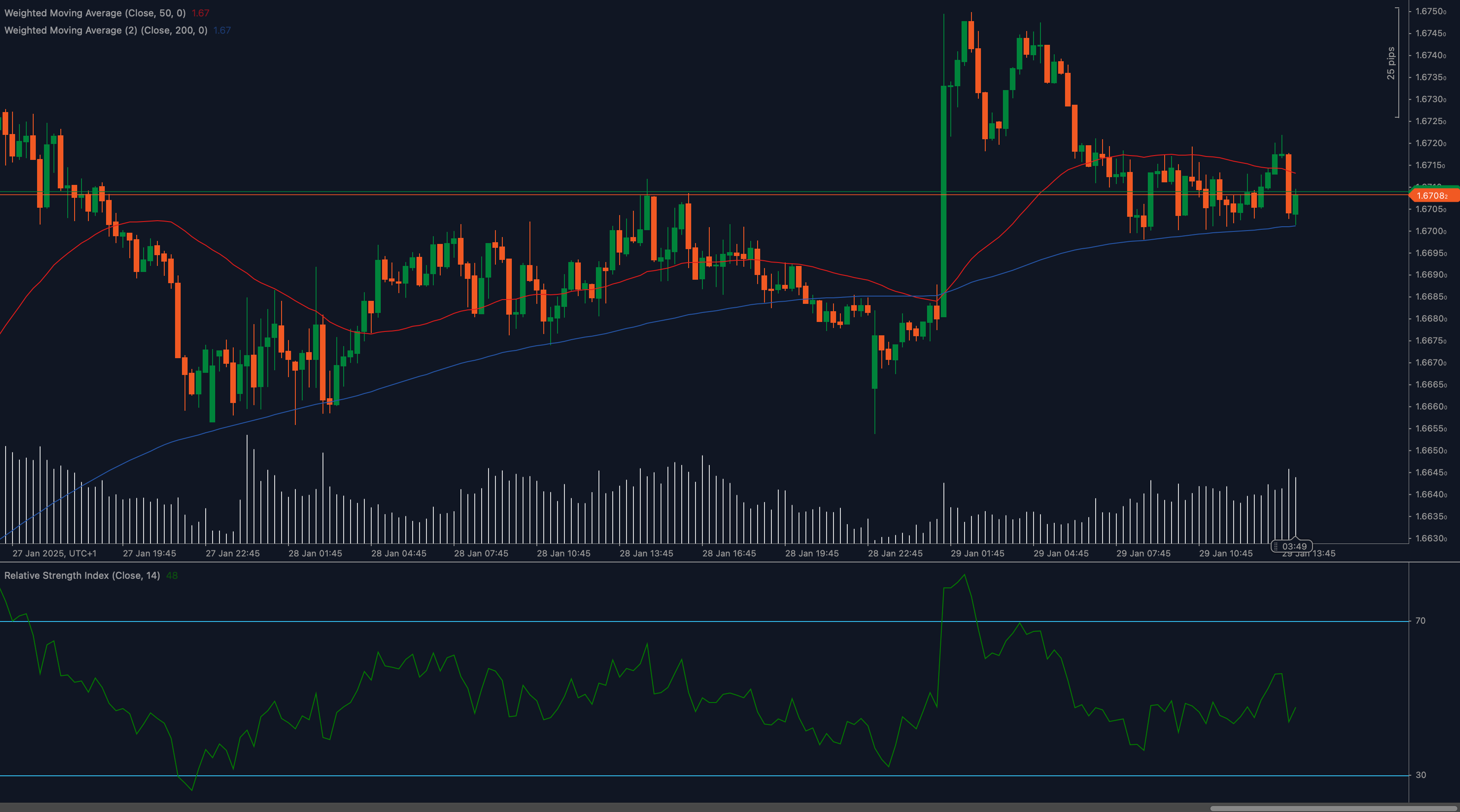

EUR/AUD remains above the 1.6700 level, but price action suggests hesitation from buyers. The pair is consolidating, with neither bulls nor bears taking decisive control, keeping traders on edge.

Technical Analysis

📈 Weighted Moving Averages Reflect Neutral Momentum

The 50 Weighted Moving Average (WMA) at 1.67 remains aligned with the 200 WMA, highlighting an uncertain trend where neither side has a clear advantage.

📊 RSI Shows Lack of Conviction

The Relative Strength Index (RSI) sits at 48, signaling indecision. A push above 50 could support further gains, while a dip below 45 might strengthen bearish momentum.

🔎 Price Levels to Watch for Breakout or Rejection

EUR/AUD is holding just above 1.6700, a crucial level for trend continuation. Bulls need a decisive move higher to sustain momentum, while sellers will aim to push prices below support.

Key Levels to Watch

Support Levels:

- 1.6700: Key psychological support, defining the current consolidation.

- 1.6680: Next downside target if selling pressure builds.

Resistance Levels:

- 1.6730: Immediate resistance limiting upside movement.

- 1.6750: Strong resistance level that needs to be cleared for further gains.

Fundamental Drivers

EUR/AUD is being influenced by risk sentiment, central bank expectations, and macroeconomic data. The euro is finding support from recent stability in Eurozone markets, while the Australian dollar remains sensitive to commodity price movements and RBA guidance. This week’s key events, including Eurozone inflation reports and Australian trade data, will shape market direction.

Outlook

The 1.6700 level remains pivotal. A breakout above 1.6730 could open the path toward 1.6750, while failure to hold above 1.6700 may trigger a decline toward 1.6680.

Traders should closely watch price reactions at key levels and upcoming macroeconomic releases to anticipate market direction.