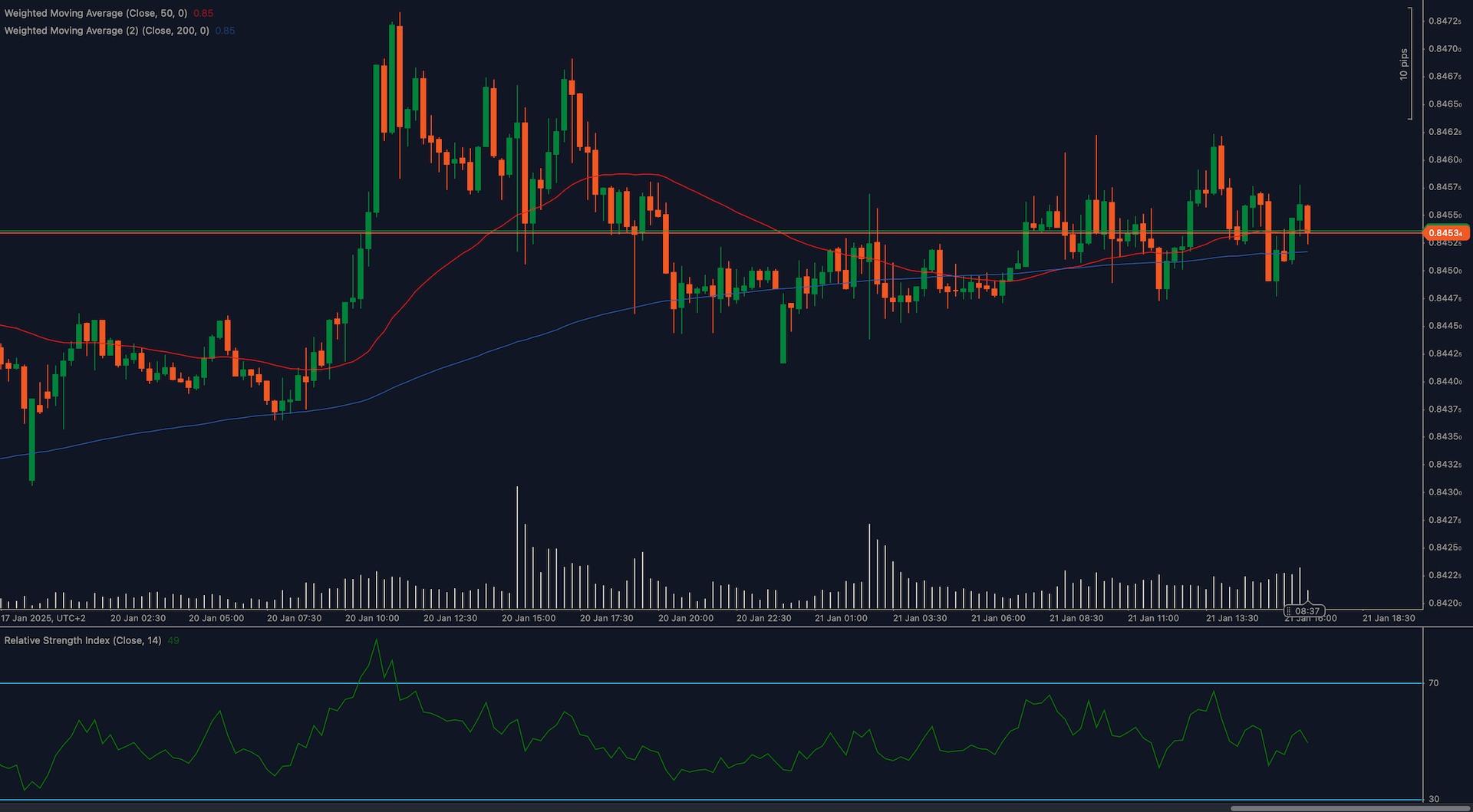

The EUR/GBP pair continues to consolidate around the 0.8455 resistance level, with buyers and sellers battling for control. The pair’s price action reflects a lack of strong momentum, keeping the pair within a narrow range.

Technical Overview

📈 Moving averages offer support. The price remains supported by the 50 Weighted Moving Average (WMA) at 0.8450 and the 200 WMA at 0.8440, which are aligned flatly, signaling a lack of strong directional bias. A clear break above 0.8455 could drive the pair higher to test 0.8470, while failure to sustain above this level may result in a pullback to 0.8440 or lower.

📊 RSI signals neutrality. The Relative Strength Index (RSI) is hovering near 50, indicating equilibrium between buyers and sellers. A move above 60 could signal renewed bullish momentum, while a drop below 40 may suggest bearish pressure resuming.

Key Levels to Watch

- Support: 0.8450 (short-term), 0.8440 (major)

- Resistance: 0.8455 (current), 0.8470 (next target)

Fundamental Perspective

The EUR/GBP remains influenced by divergent economic narratives from the Eurozone and the UK. With the Eurozone facing mixed economic data and the UK seeing lingering inflation concerns, market participants remain cautious ahead of key events, such as ECB statements and UK economic updates.

Outlook

A decisive move above 0.8455 could indicate bullish control, targeting 0.8470, while failure to break could result in a retreat to the 0.8440 support zone. For now, consolidation remains the dominant theme.