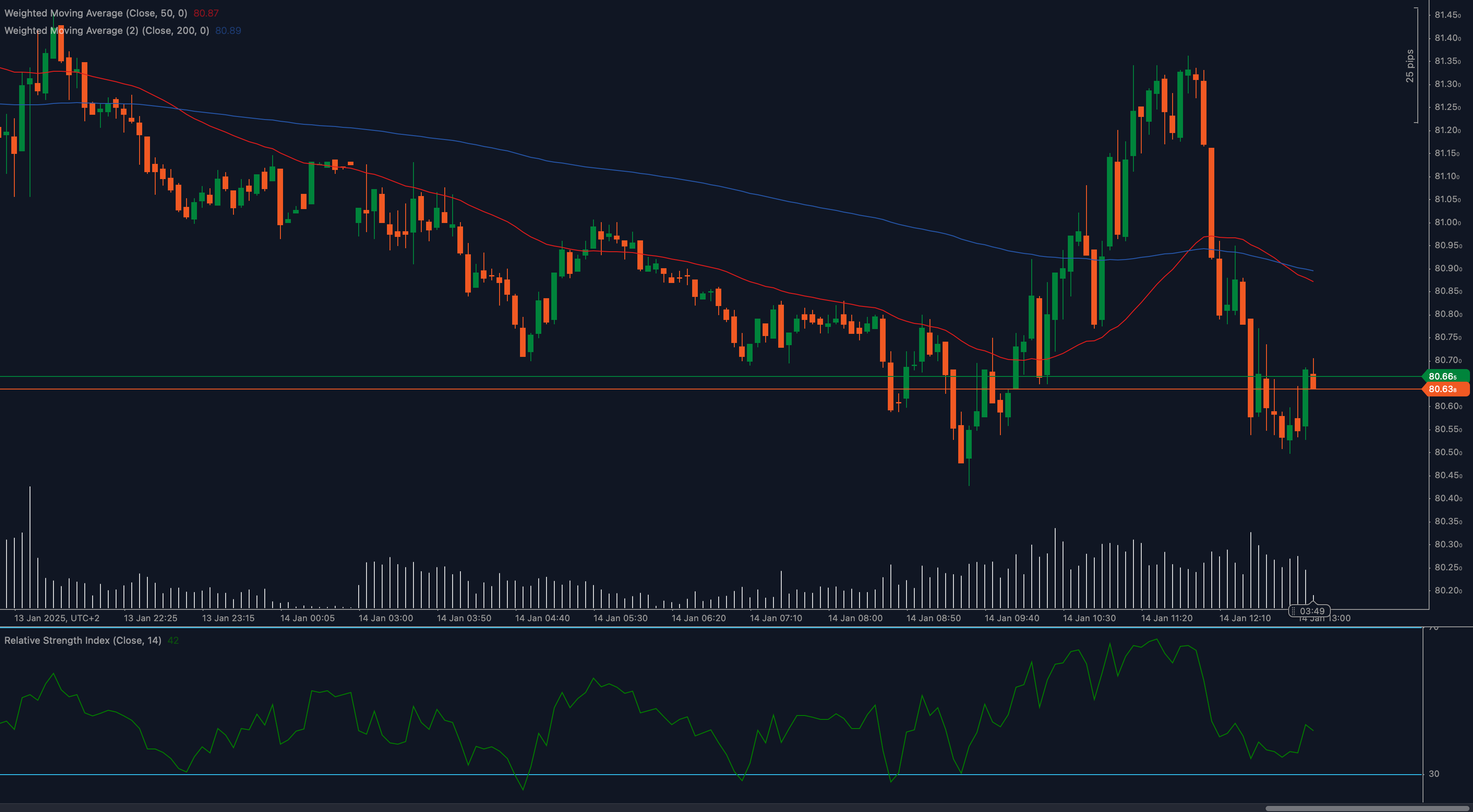

Brent crude oil (UKOIL) is testing a critical 80.63 support level, attempting to hold steady after recent selling pressure. The price action suggests buyers are stepping in, but key resistance levels remain in play.

📉 Moving averages signal caution. The 50 Weighted Moving Average (WMA) and 200 WMA are both positioned above the price, acting as resistance. As long as Brent crude remains below these levels, the recovery could face challenges. A break above 80.85 could trigger further upside toward 81.35.

📊 RSI is showing signs of stabilization. The Relative Strength Index (RSI) has climbed back to 42, suggesting selling pressure may be easing. However, for a bullish confirmation, RSI needs to break above 50 to indicate stronger momentum.

💡 Key levels to watch:

- Support: 80.63 (current), 80.30 (next key level)

- Resistance: 80.85 (minor), 81.35 (major breakout zone)

⚠️ Fundamentals remain mixed. Brent crude has been under pressure due to global demand concerns and stronger US Dollar (DXY). However, OPEC+ supply adjustments and geopolitical risks could still provide support. Traders should monitor upcoming inventory reports and economic data for further direction.

🌍 The 80.63 level is a key test—if it holds, we could see a rebound toward 81.35, but a breakdown could open the door to 80.30 or lower. Let’s see if buyers can step up!