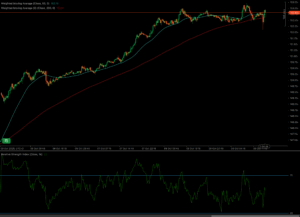

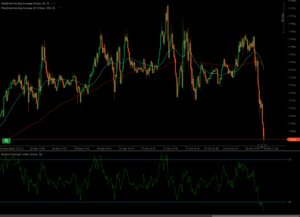

XAGUSD Technical Analysis: Testing Key Resistance

XAGUSD is retesting resistance after a recent uptrend. Key levels and moving averages are analyzed.

XAGUSD is retesting resistance after a recent uptrend. Key levels and moving averages are analyzed.

GBPJPY is balancing between a bullish surge and a sharp pullback, testing key support. What’s next?

UKOIL is at a critical juncture, balancing between a recent downturn and a potential bounce. The index’s reaction to key moving averages will dictate near-term direction.

DXY analysis: Testing key support at 99.05. Key levels, trading scenarios, and technical insights.

Technical analysis of USDJPY, focusing on support and resistance, moving averages, and potential trading setups.

XAGUSD at a crossroads: Will it hold support or break down? Get our expert technical analysis and trading scenarios.

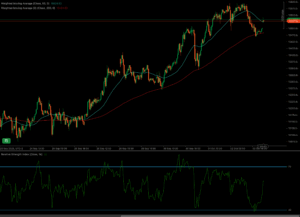

XAUUSD is at a pivotal point after a volatile week. Our technical analysis examines the critical resistance at the 200-period WMA around 3865, the role of the RSI, and key price levels that will dictate gold’s next move.

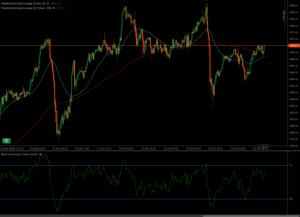

The ESP35 index is at a critical technical juncture. After a strong rally and subsequent correction, the price bounced off the 200-period WMA and is now challenging the 50-period WMA as resistance. This analysis explores key levels and potential scenarios.

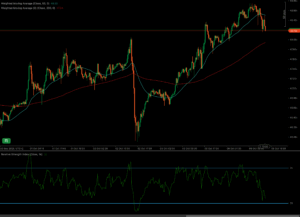

After hitting a peak near 1.1780, the EURUSD pair experienced a sudden and sharp decline, breaking through crucial moving average support. The RSI is now deep in oversold territory, signaling potential for either a short-term bounce or further capitulation.

Trading over-the-counter derivatives involves leverage and carries significant risk to your capital. These instruments are not appropriate for all investors and could result in losses exceeding your original investment. You do not possess ownership or rights to the underlying assets. Always ensure you are trading with funds you can afford to lose.