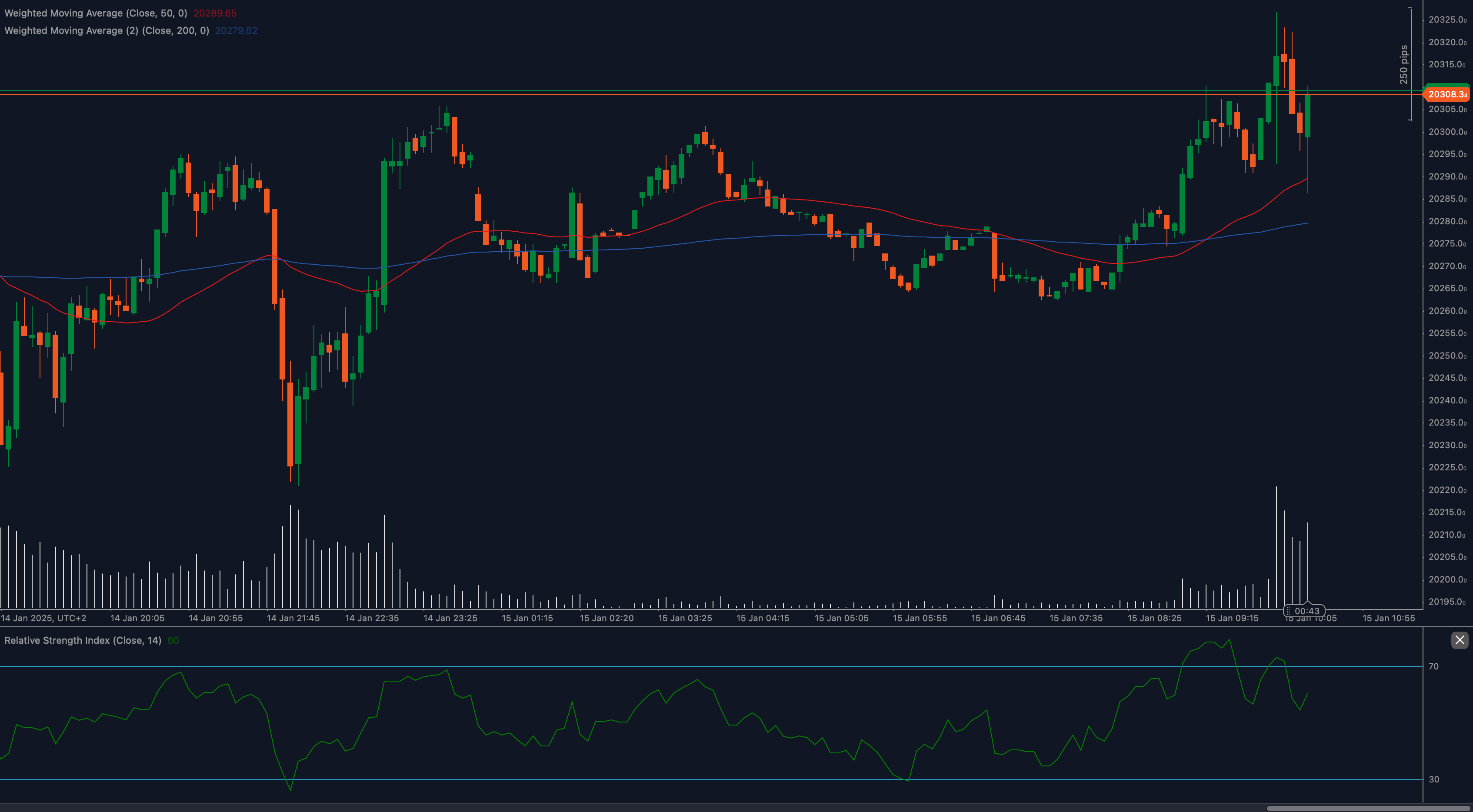

The DAX40 index is at a major turning point, testing the crucial 20,308 resistance level. Bulls have been in control for most of the recent rally, pushing prices higher as momentum builds. However, now we’re at a decision point—can the index push through this resistance and continue its bullish trend, or will sellers take control and force a correction?

📈 Moving averages confirm bullish strength, but risk remains. The 50 Weighted Moving Average (WMA) has been trending upward and has successfully crossed above the 200 WMA, forming a golden cross. This is one of the strongest bullish signals in technical analysis, indicating that the longer-term trend is shifting in favor of the buyers. However, the price is now at a key resistance zone, and while moving averages provide support, they don’t guarantee a breakout. If the price fails to hold above 20,308, we could see a rejection that sends the index lower, with the first downside target near 20,280 and possibly 20,250 if selling pressure increases.

📊 RSI is flashing warning signs as overbought conditions approach. The Relative Strength Index (RSI) is hovering near 70, which indicates that the market is approaching overbought territory. When RSI reaches these levels, it often signals that a pullback is likely, as traders take profits and momentum slows. However, RSI is still holding above 60, meaning that bullish momentum is still present. If RSI remains strong and doesn’t show significant divergence, a breakout past 20,308 could be possible. If RSI starts rolling over, it may indicate that the rally is losing strength, increasing the chances of a retracement.

🔎 Key levels to watch:

- Support: 20,280 (short-term), 20,250 (major support level), 20,220 (extended pullback)

- Resistance: 20,308 (current test), 20,350 (next breakout target), 20,400 (long-term bullish target)

💡 Market fundamentals are adding to the uncertainty. The recent bullish momentum in DAX40 has been largely fueled by improving Eurozone economic data and strong corporate earnings. Investors have been optimistic about European Central Bank (ECB) policy, with speculation that rate hikes may slow if inflation data starts easing. At the same time, geopolitical risks and global growth concerns continue to create uncertainty in the market. If investors start taking profits at these highs, we may see selling pressure increase, triggering a possible pullback.

🌍 The 20,308 resistance level is a critical test. A strong breakout above this level could signal further bullish movement toward 20,350, with the potential to extend gains toward 20,400 in the coming sessions. However, if resistance holds firm, we could see a retracement back to the 20,280 support zone or even lower if selling accelerates. Let’s see how the market reacts to this critical resistance area!