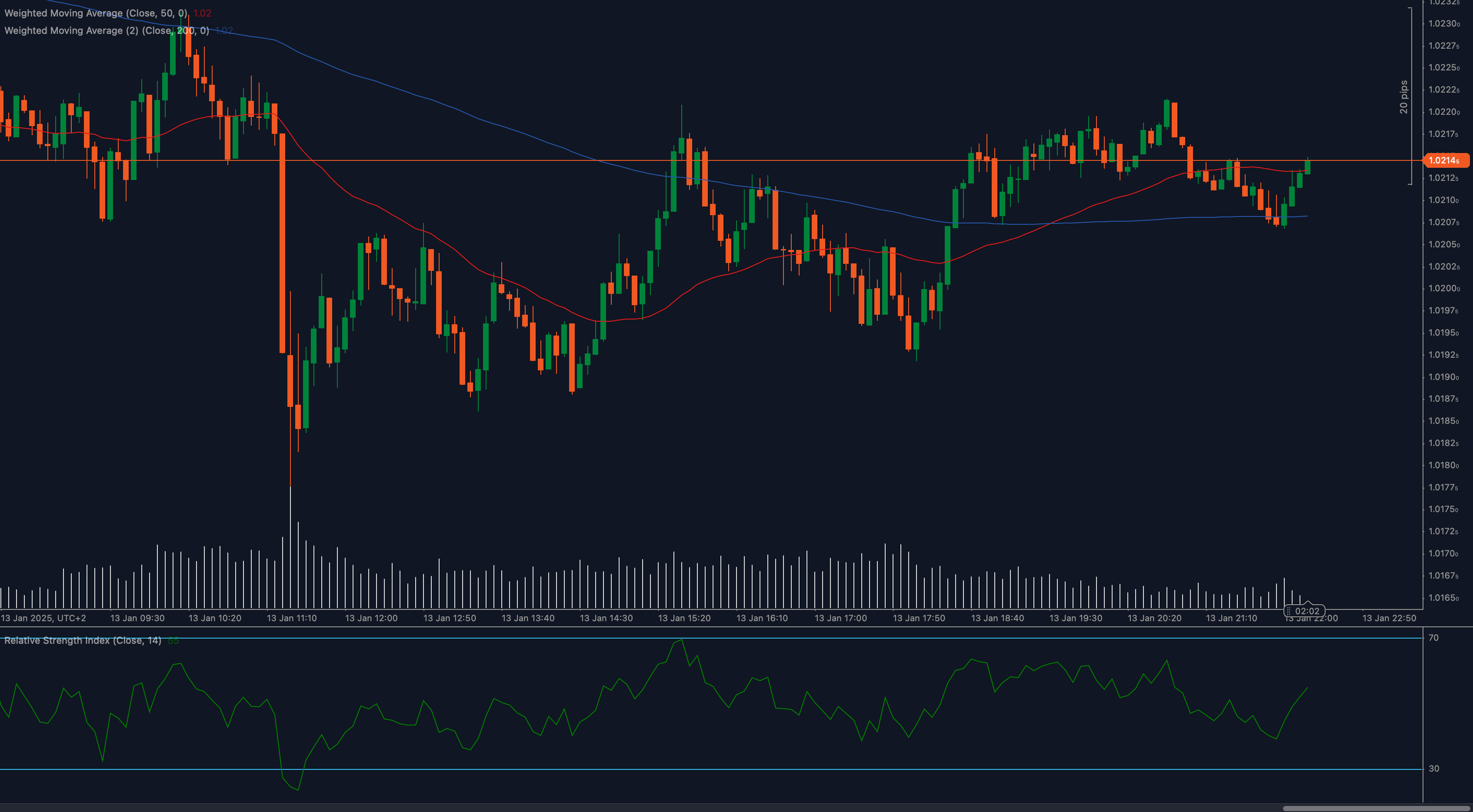

The EUR/USD pair is pressing against a key 1.0214 resistance level, showing signs of bullish strength. With momentum building, traders are watching closely to see if the euro can break through, or if sellers will step in to push the price lower.

📈 Moving averages are creating mixed signals. The price is currently battling the 200 Weighted Moving Average (WMA), which could act as resistance. However, the 50 WMA is rising, offering some support to buyers. If bulls can hold above 1.0200, we could see another push toward 1.0230.

📊 RSI is climbing, but not overbought yet. The Relative Strength Index (RSI) is moving toward 60, indicating bullish momentum. If RSI pushes above 70, we may see further upside, but traders should watch for possible exhaustion if overbought conditions develop.

💡 Key levels to watch:

- Support: 1.0200 (psychological), 1.0185 (50 WMA)

- Resistance: 1.0214 (current test), 1.0230 (next breakout level)

⚠️ Fundamentals could play a big role. The US Dollar (DXY) remains strong, backed by rising Treasury yields and a cautious Federal Reserve. However, if Eurozone data surprises positively, we might see the euro gain strength and push through resistance.

🌍 The 1.0214 level is crucial—a breakout could send EUR/USD toward 1.0230, while rejection may lead to a retest of 1.0185. The next session will be key in determining the euro’s next move!