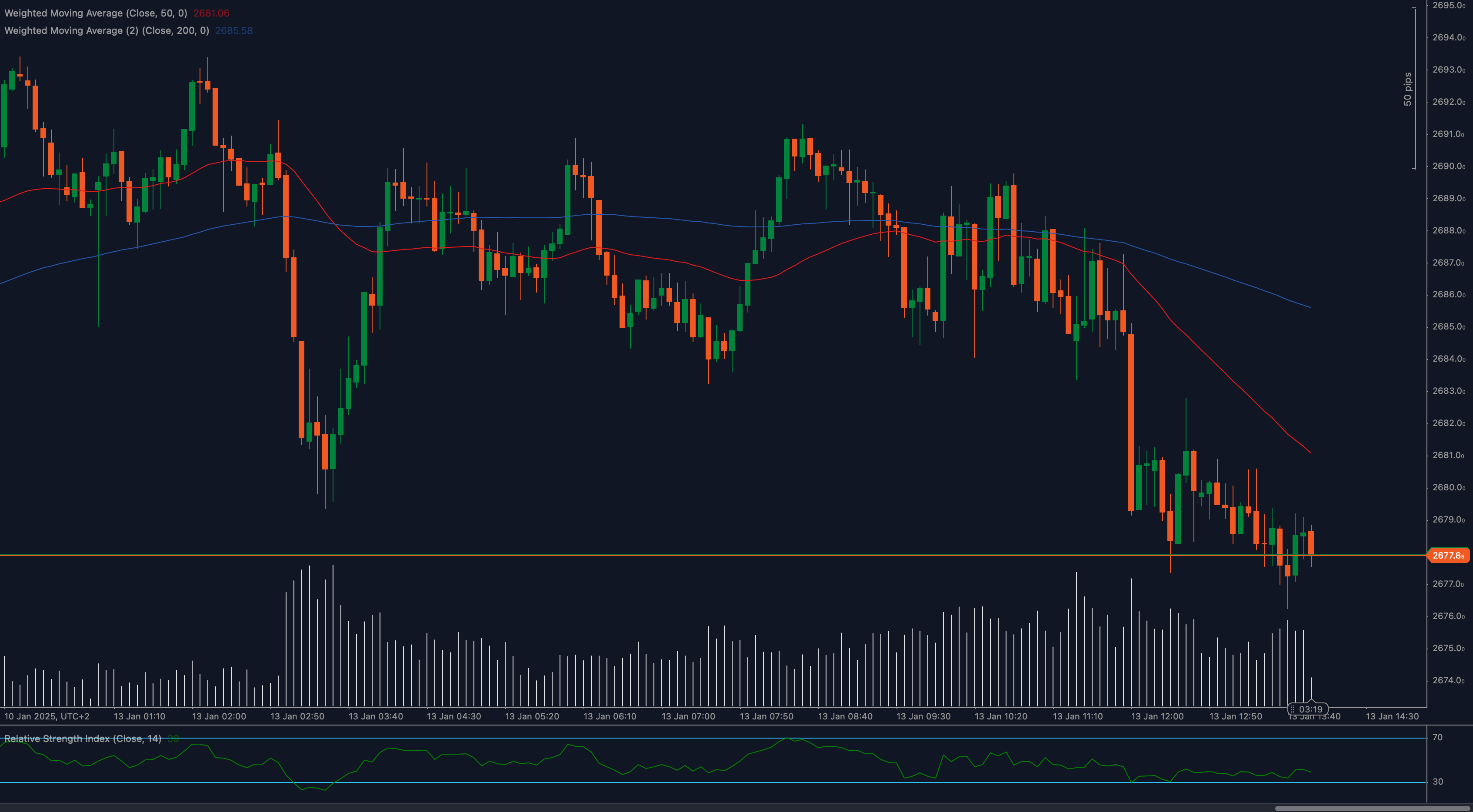

Gold price (XAU/USD) is at a critical 2,677 support level, trying to hold its ground after a sharp drop. Sellers remain in control, but buyers could step in soon if this level holds. The question now—will gold bounce, or are we headed lower?

📉 Moving averages confirm a bearish trend. The price is below both the 50 Weighted Moving Average (WMA) and the 200 WMA, signaling strong selling pressure. If gold stays under these levels, the downtrend is likely to continue. A push above 2,695 would be needed to change the outlook.

📊 RSI is showing weak momentum. The Relative Strength Index (RSI) is struggling below 40, keeping gold under pressure. If it dips under 30, we could enter oversold territory, but that alone won’t confirm a reversal. Buyers need to push RSI above 50 to gain control.

💡 Key levels to watch:

- Support: 2,677 (current), 2,660 (next key level)

- Resistance: 2,685 (minor), 2,695 (major breakout zone)

⚠️ Fundamentals are keeping gold weak. A stronger US Dollar (DXY) and rising Treasury yields are pushing gold lower. If the Federal Reserve sticks to a hawkish stance, gold could struggle to recover. However, if inflation fears rise or risk sentiment shifts, safe-haven demand might help gold bounce.

🌍 The 2,677 level is crucial—a breakdown could send gold toward 2,660, while a strong bounce could open the way for a test of 2,695. Let’s see if buyers can step in, or if sellers will keep control!