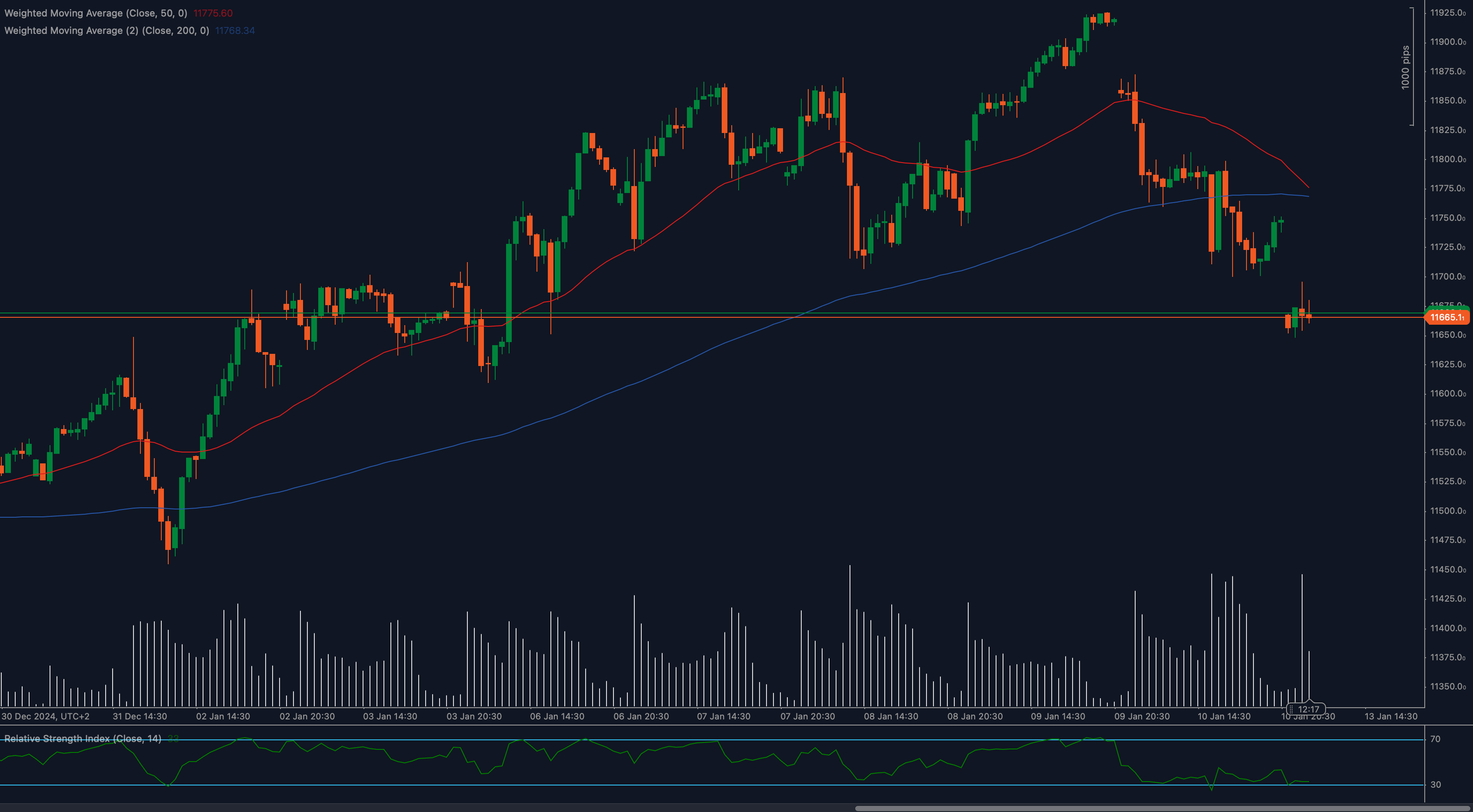

The ESP35 index is teetering on the edge of a major support zone after a sharp pullback from recent highs. Sellers have gained control, driving the price down toward a key 11,665 level, where historical price action has seen significant reactions. Traders are closely watching whether this level will hold or if a deeper breakdown is on the horizon.

📉 Moving averages are reinforcing the bearish momentum. The index has decisively lost the 50 Weighted Moving Average (WMA), which had previously acted as dynamic support. Even more concerning for bulls is that the price is now trading below the 200 WMA, indicating that a longer-term bearish shift may be underway. As long as ESP35 remains below these key levels, the risk of further downside remains elevated.

📊 RSI signals growing bearish momentum. The Relative Strength Index (RSI) is currently hovering below the 40 level, reflecting sustained selling pressure. A drop below 30 would officially push the index into oversold territory, but without signs of bullish divergence, the current trend remains intact. Any recovery attempt will need to see RSI reclaim the 50 zone before a reversal can be considered.

📍 Support and resistance levels are coming into play. The 11,665 area has been tested multiple times in recent sessions, making it a crucial inflection point. If price action fails to hold here, the next significant support lies near 11,500, a level that aligns with previous consolidation zones. On the upside, immediate resistance now sits at 11,775, where the 50 WMA is likely to act as a barrier for any recovery attempts.

⚠️ Fundamentals and risk sentiment are driving volatility. The recent downturn in ESP35 aligns with broader market caution as investors assess economic data and central bank policies. Eurozone growth concerns and geopolitical uncertainties continue to weigh on risk appetite, increasing the likelihood of further pressure on equities. A shift in sentiment or dovish signals from the ECB could provide some relief, but until then, caution remains warranted.

🌍 If the 11,665 level fails to hold, expect momentum to accelerate toward 11,500 and potentially lower. Bulls need a decisive reclaim of the 50 WMA and a break above 11,775 to regain control. Until then, the downtrend remains dominant, and traders should approach with a bearish bias unless key reversal signals emerge.