📊 Market Overview

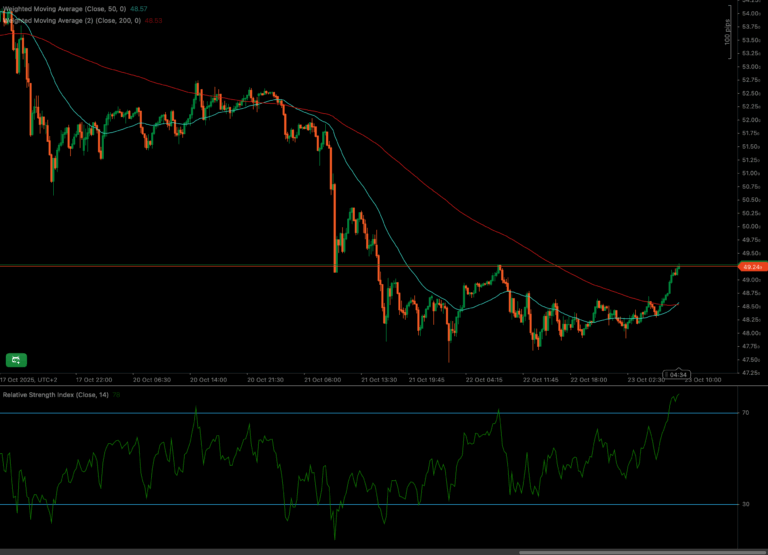

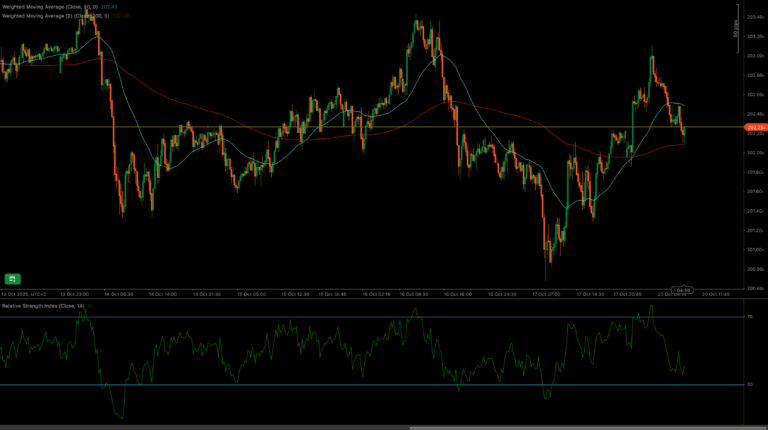

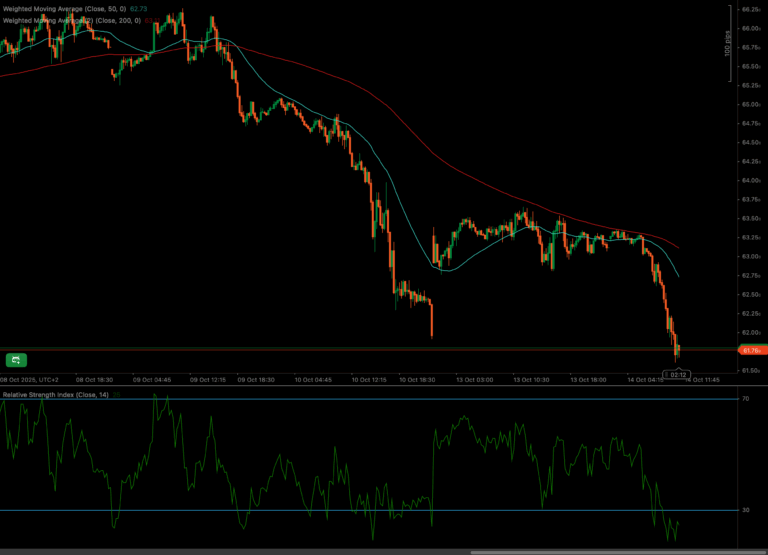

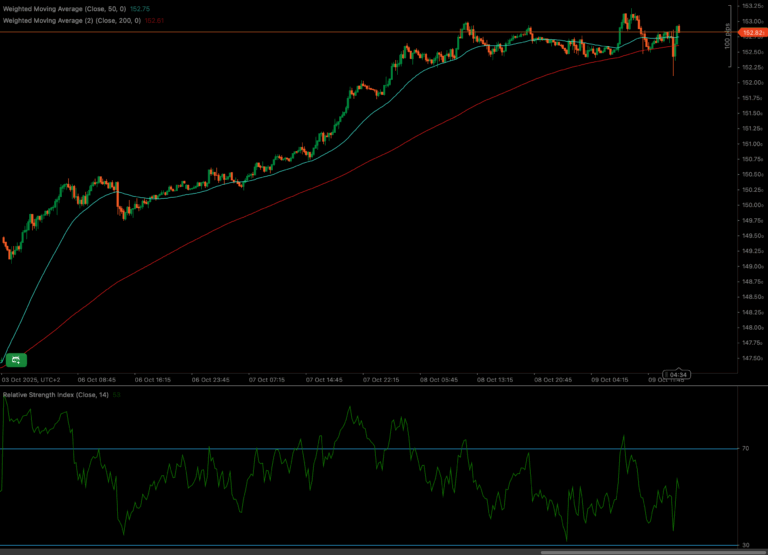

The GBPJPY has experienced a significant uptrend recently, pushing to new short-term highs before facing a sharp correction. The index is currently consolidating around a pivotal support level, with market participants closely watching for a potential rebound or further downside momentum.

After a bullish surge that saw the GBPJPY climb steadily, the index met strong resistance. This was followed by a period of profit-taking, bringing the price back towards key moving averages and established support zones.

📈 Technical Analysis

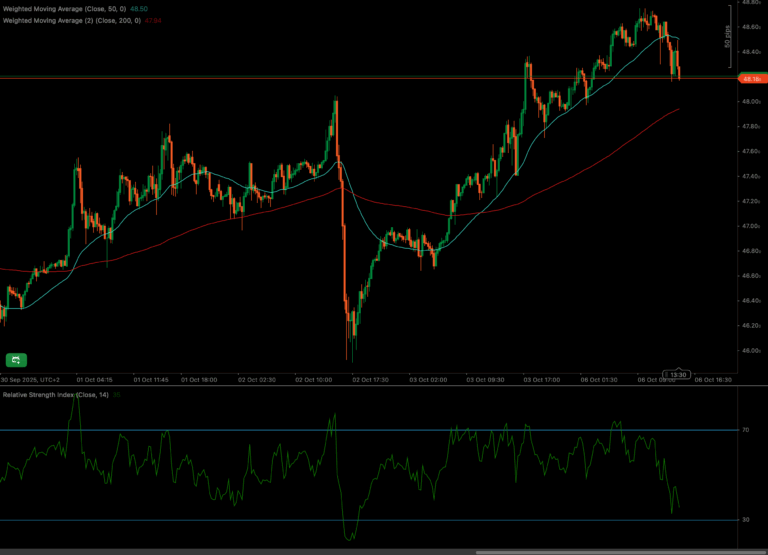

Key Support and Resistance Levels

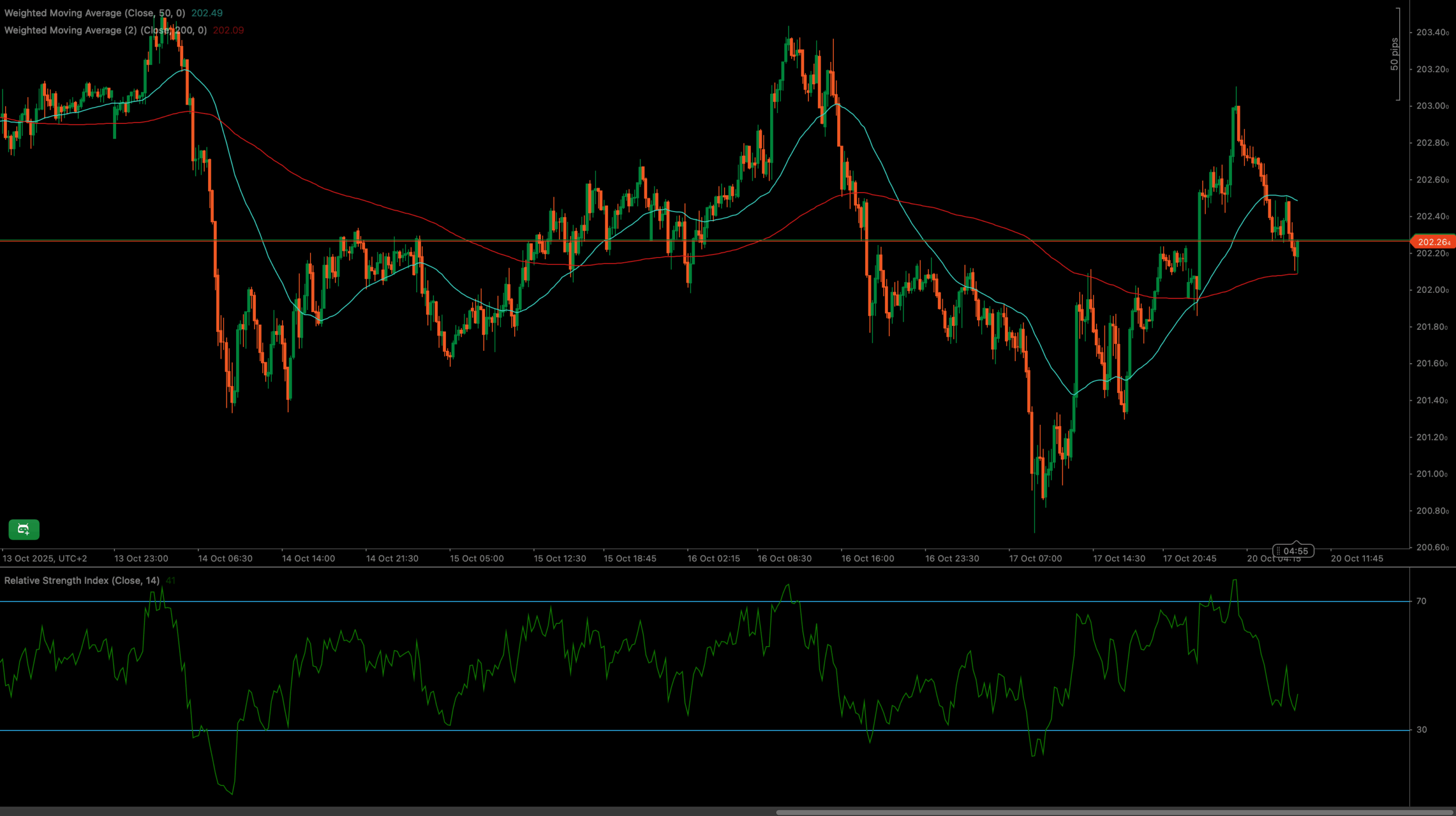

The immediate resistance for the GBPJPY is observed near the 50-period Weighted Moving Average (WMA) at approximately 202.49, followed by the prior swing high around 203.00. On the downside, a crucial support level has formed around 202.26, which previously acted as resistance. A break below this level could see the GBPJPY test the 200-period WMA near 202.09.

Moving Average Analysis for GBPJPY

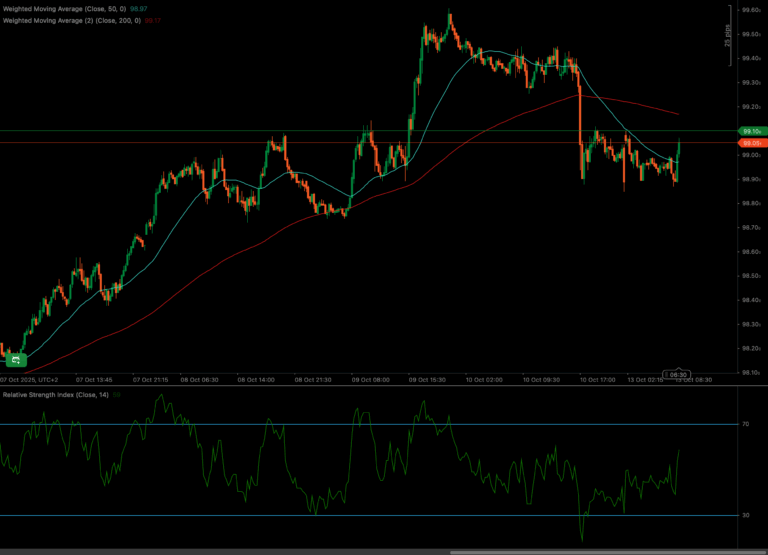

Initially, the GBPJPY demonstrated strong bullish momentum, staying well above both the 50 WMA (cyan line) and the 200 WMA (red line). The 50 WMA was comfortably above the 200 WMA, reinforcing the short-to-medium term bullish trend. However, recent declines may have pushed the GBPJPY below its 50 WMA, signaling a shift in immediate momentum and indicating that the bulls are losing control in the very short term. The 200 WMA now stands as a critical dynamic support level.

RSI and Momentum Shift in GBPJPY

The Relative Strength Index (RSI) reflects the recent selling pressure on the GBPJPY. The RSI moved from above the 70 overbought level to the 40s, indicating weakening momentum. This level may be approaching the oversold threshold of 30, suggesting that the asset might be nearing a point where buying interest could re-emerge, or it could signal further weakness if the RSI breaks below 30. Previously, the RSI may have been in overbought territory, indicating an unsustainable rally before the current pullback.

Volume Spike and Market Participation

While specific volume data is not visible on this chart, observing volume alongside price action is crucial for confirming trends. An increase in selling volume during the recent decline would confirm bearish pressure, whereas a spike in buying volume at current support could signal a potential reversal for the GBPJPY. Traders should monitor volume on their platforms for additional confirmation.

Candlestick Tone and Market Reaction for GBPJPY

The recent candlestick patterns for the GBPJPY may predominantly feature bearish candles, especially following a recent peak. This indicates strong selling pressure and profit-taking. However, around key support zones, there might be smaller candles and some bullish candles attempting to form, suggesting indecision or a battle between buyers and sellers at this critical juncture. A clear breakout or breakdown from this range, confirmed by subsequent candles, will be key.

🔍 Market Outlook & Trading Scenarios

Bullish Scenario

If the GBPJPY can successfully hold its key support level and reclaim the 50 WMA, we could see a rebound targeting the previous highs. A sustained move above the prior peak would indicate a resumption of the broader bullish trend.

Neutral Scenario

The GBPJPY might consolidate between the 200 WMA and the 50 WMA as the market digests recent moves. Sideways trading would likely persist until a clear catalyst emerges or a strong break out of this range occurs.

Bearish Scenario

A decisive break below the key support around 202.26, especially if accompanied by increasing bearish momentum and a drop in RSI below 30, could lead the GBPJPY to test the 200 WMA near 202.09. Further weakness below the 200 WMA could open the path to lower support levels.

💼 Trading Considerations

- Bullish setup: Look for confirmation of support, such as bullish candlestick patterns or a cross back above the 50 WMA. Target initial resistance at the prior high.

- Breakout setup: A break above the 50 WMA could signal a move towards the prior high. Conversely, a break below key support could signal a move towards the 200 WMA.

- Bearish setup: A confirmed breakdown below key support, with the RSI failing to rebound from 30, could offer short opportunities targeting the 200 WMA.

🏁 Conclusion

The GBPJPY is at a critical juncture, balancing between a recent bullish surge and a sharp pullback. The index’s ability to hold its support zone and react to the 50 WMA and 200 WMA will dictate its near-term direction. The weakening RSI suggests caution, but also potential for a bounce if oversold conditions are met.

Traders should monitor these key technical levels closely. A decisive move above the 50 WMA could signal renewed bullish interest, while a break below current support could confirm further downside momentum for the GBPJPY.

⚠️ Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Always consult a licensed financial advisor before making trading decisions.