Executive Summary

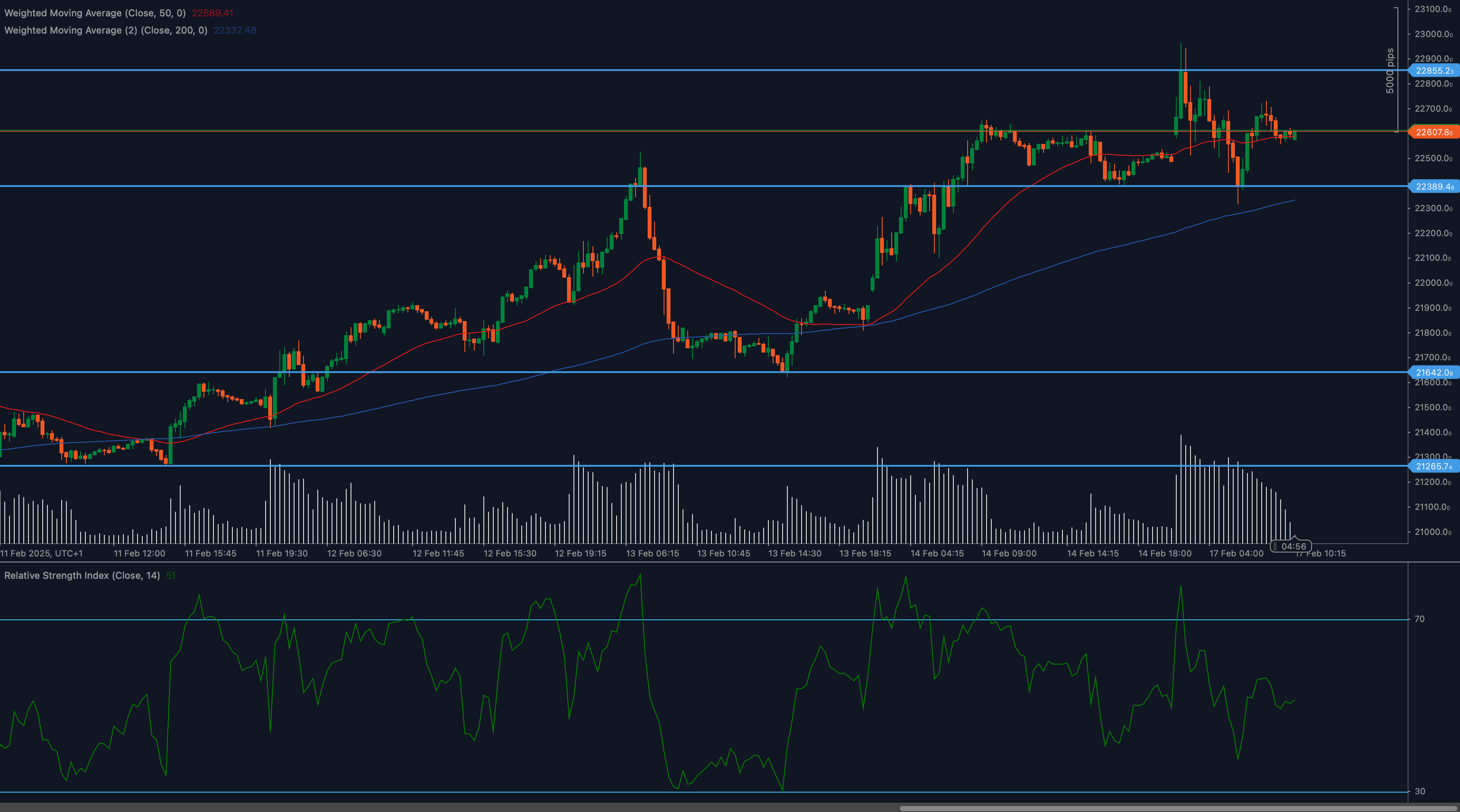

The Hang Seng Index (HSI) is currently in a consolidation phase, trading between key support at 22,607 and resistance at 22,855. While recent gains have been positive, the index is now facing a crucial test. This analysis examines the technical indicators, key levels, and fundamental factors that will likely determine the HSI’s next move.

Detailed Technical Analysis

- Consolidation Phase: The HSI has been consolidating after a period of gains. This consolidation indicates a period of indecision in the market.

- Moving Averages (MAs):

- The 50 Weighted Moving Average (WMA) at 22,589 is holding just below the price, reinforcing near-term support. Meanwhile, the 200 WMA at 22,332 suggests underlying strength in the market.

- Relative Strength Index (RSI): The RSI sits at 51, meaning that the index is in a neutral position.

- Bullish Signal: A sustained move above 55 on the RSI would suggest increasing buying momentum.

- Bearish Signal: A drop below 45 would indicate increasing selling pressure.

- Key Support and Resistance Levels:

- Support:

- 22,607: This is the immediate support level, and it’s currently holding.

- 21,625: A significantly lower support level.

- 20,000 and 20,500: Key support levels.

- Resistance:

- 22,855: The immediate resistance level.

- 23,000: A psychologically important round number and a potential upside target.

- 23,500 and 23,700: Key resistance levels.

- Support:

Fundamental Factors Influencing the HSI

- Global Market Sentiment: The overall performance of global stock markets, particularly in the US and China, significantly impacts the HSI.

- China’s Economic Outlook: The health of the Chinese economy is a major driver of the HSI. Key economic data releases and policy decisions from the People’s Bank of China (PBOC) are closely watched.

- Hong Kong’s Stock Market Performance: Specific events and news related to companies listed on the Hong Kong Stock Exchange can influence the index.

- Geopolitical Developments: Geopolitical tensions, particularly those involving China, can create volatility in the HSI.

- Property Sector: Concerns about the Chinese property sector, a key component of the economy, are a significant factor.

Outlook and Trading Considerations

- Bullish Scenario: A decisive breakout above 22,855, ideally confirmed by an RSI move above 55 and strong trading volume, would suggest a potential rally towards 23,000 and potentially higher.

- Bearish Scenario: A failure to hold the 22,607 support level, accompanied by an RSI drop below 45, would signal increased downside risk, potentially leading to a test of the 21,625 support.

Trading Recommendation:

The HSI is at a critical juncture. Traders should remain patient and wait for confirmation of a breakout or breakdown before committing to significant positions.

- Aggressive Traders: Might consider small long positions on a confirmed breakout above 22,855, with tight stop-loss orders below.

- Conservative Traders: Should wait for a clear directional signal (breakout or breakdown) before entering trades.

- Short Sellers: Might consider small short positions if the index shows clear signs of weakness below 22,607, with tight stop-loss orders above.

Volume is crucial: Any breakout or breakdown should be accompanied by strong trading volume to confirm the move’s validity.

Disclaimer: This analysis is provided for informational purposes only and should not be considered financial advice. Trading in financial markets carries inherent risks, and past performance is not a guarantee of future results. Always conduct your own independent research and consult with a qualified financial advisor before making any investment decisions.