Overview

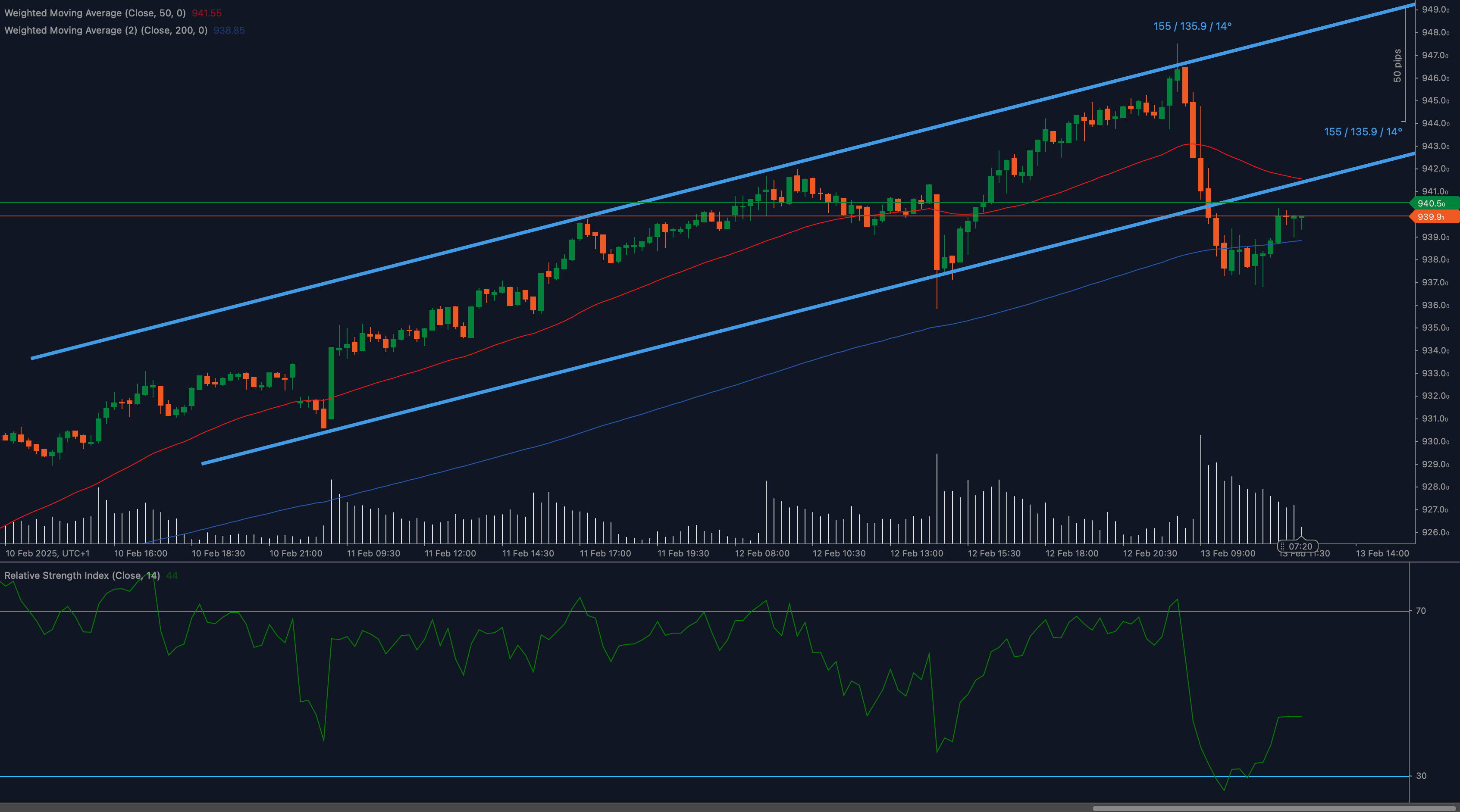

The AEX 25 Index (AEX25) has recently experienced a significant shift in its technical outlook. After a period of trading within a rising channel, the index has broken below this pattern, signaling potential weakness. The index is currently testing a crucial resistance level around 940 after a sharp decline. While buyers are attempting a recovery, the overall market sentiment suggests continued bearish pressure.

Technical Analysis

- 📉 Channel Breakdown and Weakness: The AEX 25’s breach of its previously established rising channel is a significant technical development. The price is now struggling to reclaim the lower boundary of this channel, which is situated near the 940 level. This area is acting as immediate resistance.

- 📊 50-Weighted Moving Average (WMA): Adding to the resistance, the 50-Weighted Moving Average (WMA) is currently positioned at approximately 941.55. This moving average sits just above the current price action, reinforcing the 940-941.55 zone as a critical hurdle for any recovery attempt.

- 📈 Relative Strength Index (RSI) Analysis: The Relative Strength Index (RSI), a momentum oscillator, experienced a sharp drop, indicating a strong sell-off. It is now showing signs of recovery at a level of 44.

- Bullish Scenario: A sustained move above the 50 level on the RSI would suggest increasing buying momentum and could support further recovery in the index.

- Bearish Scenario: If the RSI fails to convincingly break above 50 and turns lower, it would signal that the downward pressure remains dominant.

- 🔎 Key Support and Resistance Levels: Identifying key support and resistance levels is paramount for understanding potential future price movements. The following levels are crucial to watch:

- Support Levels:

- 938: This represents the immediate support level, where buyers may attempt to stabilize the price.

- 930: If the 938 support fails, the next significant support zone is around 930. This level would likely be tested in a continued bearish scenario.

- Resistance Levels:

- 940: As mentioned, this is the immediate resistance level, representing the former channel’s lower boundary.

- 945: If buyers manage to overcome the 940 resistance, the next key resistance level to watch is 945. A breakout above this level would signal a more significant shift in momentum.

- Support Levels:

Fundamental Considerations

The AEX 25’s performance isn’t solely driven by technical factors. Several fundamental factors influence its direction:

- European Stock Market Sentiment: The overall performance of major European stock markets significantly impacts the AEX 25.

- Earnings Reports: Individual company earnings reports from constituents of the AEX 25 can cause significant index movements. Strong earnings generally support the index, while weak earnings can weigh on it.

- Global Risk Appetite: Investor sentiment towards riskier assets (like stocks) plays a crucial role. Increased risk aversion often leads to declines in stock indices like the AEX 25.

- ECB Policy: Monetary policy decisions by the European Central Bank (ECB), especially regarding interest rates and quantitative easing, can have a substantial impact on the AEX 25.

- Macroeconomic Developments: Key economic indicators, such as GDP growth, inflation rates, and unemployment figures, within the Eurozone and globally, can influence investor confidence and, consequently, the AEX 25.

Outlook and Trading Considerations

The short-term outlook for the AEX 25 hinges on its ability to reclaim the 940 level.

- Bullish Scenario: A confirmed breakout above 940, ideally accompanied by an RSI move above 50, would suggest a potential move towards the next resistance at 945.

- Bearish Scenario: Continued rejection at the 940 resistance, particularly if the RSI remains below 50, could signal another leg down, potentially targeting the 930 support level.

Trading Recommendation:

Given the current technical and fundamental backdrop, traders should exercise caution. It’s crucial to wait for confirmation signals before establishing new positions. A breakout above 940 with supporting volume and RSI confirmation could present a buying opportunity, while a failure to clear 940 might warrant considering short positions, with appropriate risk management in place.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading in financial markets involves risk, and past performance is not indicative of future results. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.