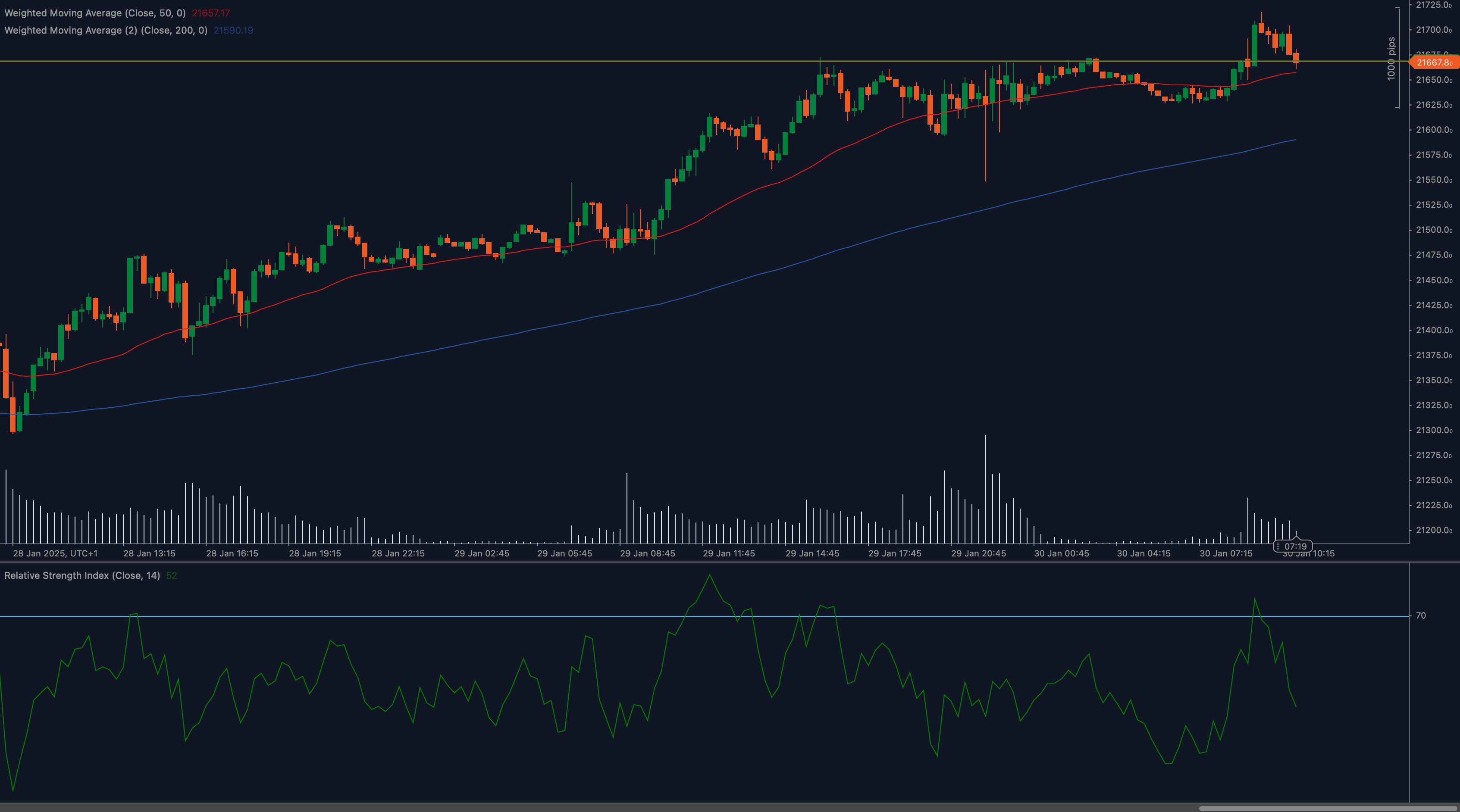

The DAX 40 index briefly touched the 21,700 resistance level before pulling back, signaling potential profit-taking or hesitation from buyers. The trend remains bullish overall, but the reaction at this level could determine the next move.

Technical Analysis

📈 Weighted Moving Averages Support Uptrend

The 50 Weighted Moving Average (WMA) at 21,657 remains well above the 200 WMA at 21,590, reinforcing the ongoing bullish trend despite the recent pullback.

📊 RSI Shows Cooling Momentum

The Relative Strength Index (RSI) is at 52, reflecting a dip from overbought conditions. A break above 60 RSI could reignite bullish momentum, while a drop below 50 RSI might signal further correction.

🔎 Key Price Levels in Focus

DAX 40 is hovering near the 21,670 support level. If this holds, bulls may attempt another push toward 21,700 and beyond. A failure to hold could lead to a deeper retracement.

Key Levels to Watch

Support Levels:

- 21,670: Immediate support zone where buyers may attempt to stabilize.

- 21,590: Stronger support aligned with the 200 WMA.

Resistance Levels:

- 21,700: Key resistance level that recently triggered a pullback.

- 21,750: Next bullish target if momentum returns.

Fundamental Drivers

The DAX 40 remains sensitive to economic data, central bank policies, and global risk sentiment. The recent pullback comes amid cautious optimism in equity markets, with investors balancing earnings reports and macroeconomic developments. This week’s European inflation data and US Fed outlook could influence further movement.

Outlook

DAX 40’s ability to hold above 21,670 will determine the short-term trend. A break above 21,700 could see continued bullish momentum toward 21,750, while a dip below this level might expose 21,590 as the next key support.

Traders should watch for price reactions at these levels and remain attentive to global equity market trends.