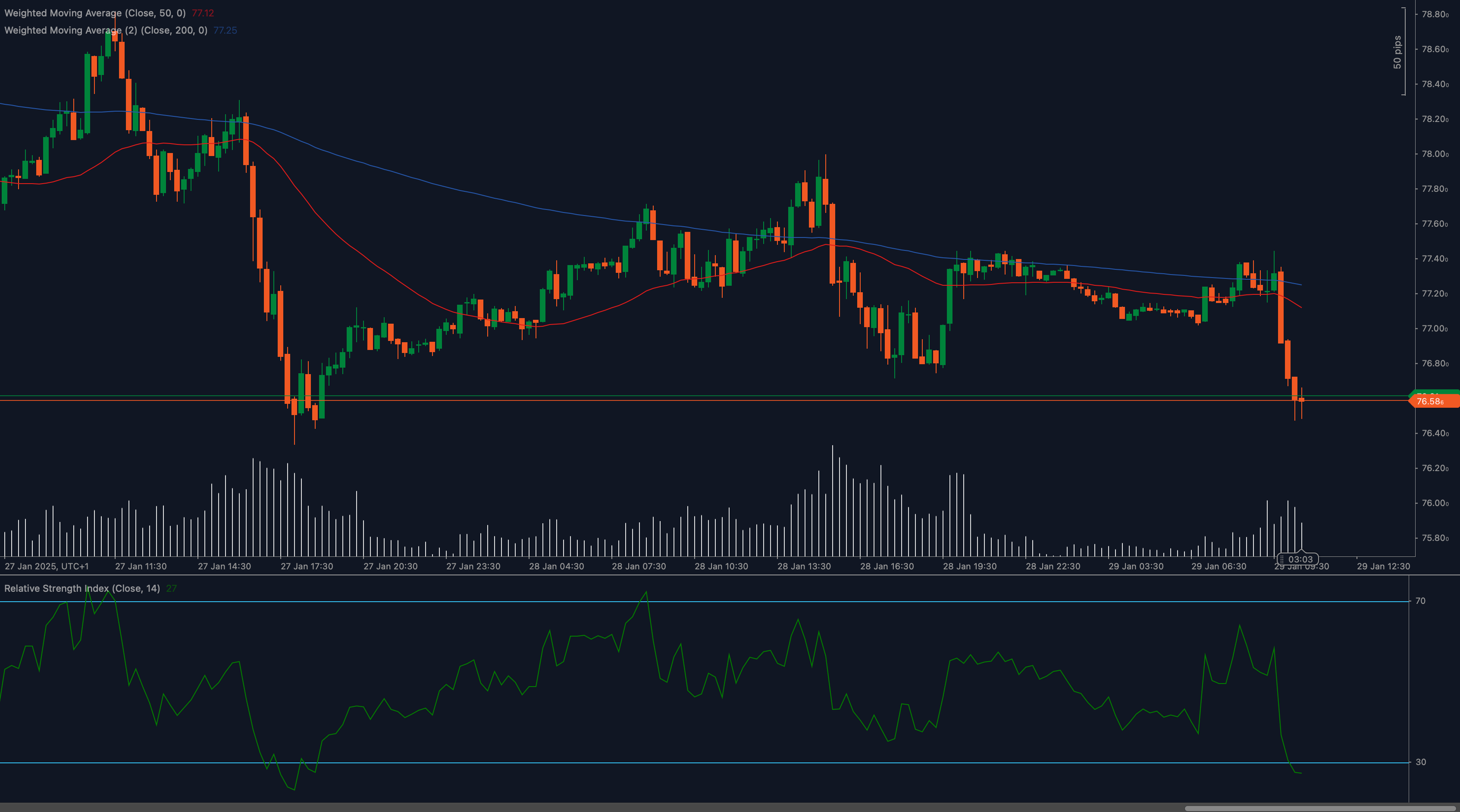

Crude oil (UKOIL) has plunged below 76.60 support, marking an acceleration of bearish momentum. With prices breaking a key level, traders are assessing whether the selloff will continue or if a reversal is on the horizon.

Technical Analysis

📉 Weighted Moving Averages Confirm Bearish Outlook

The 50 Weighted Moving Average (WMA) at 77.12 is below the 200 WMA at 77.25, reinforcing downside momentum. The price remains well below both moving averages, confirming sellers’ control.

📊 RSI Deep in Oversold Territory

The Relative Strength Index (RSI) has dropped to 27, firmly in oversold conditions. This could indicate the potential for a short-term rebound if buying interest emerges.

🔎 Support and Resistance Define the Next Move

The break below 76.60 puts focus on 76.00, a psychological support level. If prices fail to hold, the next downside target lies near 75.50, while a bounce would need to reclaim 76.60 to signal recovery.

Key Levels to Watch

Support Levels:

- 76.00: Immediate support where buyers may step in.

- 75.50: Deeper support level in case selling pressure persists.

Resistance Levels:

- 76.60: Broken support, now acting as resistance.

- 77.12: Resistance at the 50 WMA.

Fundamental Drivers

Oil prices have faced increased selling pressure as demand concerns and global economic uncertainty weigh on sentiment. Recent data on slower manufacturing growth and expectations of prolonged high interest rates have dampened market confidence. Meanwhile, OPEC supply policies and geopolitical factors remain key influences on price action.

Outlook

Crude oil’s decline below 76.60 suggests further weakness may be ahead unless a recovery effort materializes. If buyers fail to reclaim this level, deeper declines toward 76.00 or 75.50 could unfold. However, with RSI in oversold conditions, a short-term bounce is possible if demand stabilizes.

Traders should keep an eye on price reactions at key levels and global supply-demand developments to assess potential trend shifts.