The Swiss Market Index (SMI), often referred to as the Switzerland 20, is currently trading near the 12,250 resistance level, a critical zone that has historically tested bullish momentum. Market participants are eagerly observing whether the index will break through this barrier or retreat for consolidation.

The broader market sentiment remains cautiously optimistic as economic data out of Switzerland shows resilience. However, technical indicators are providing mixed signals that traders must interpret carefully.

Technical Analysis

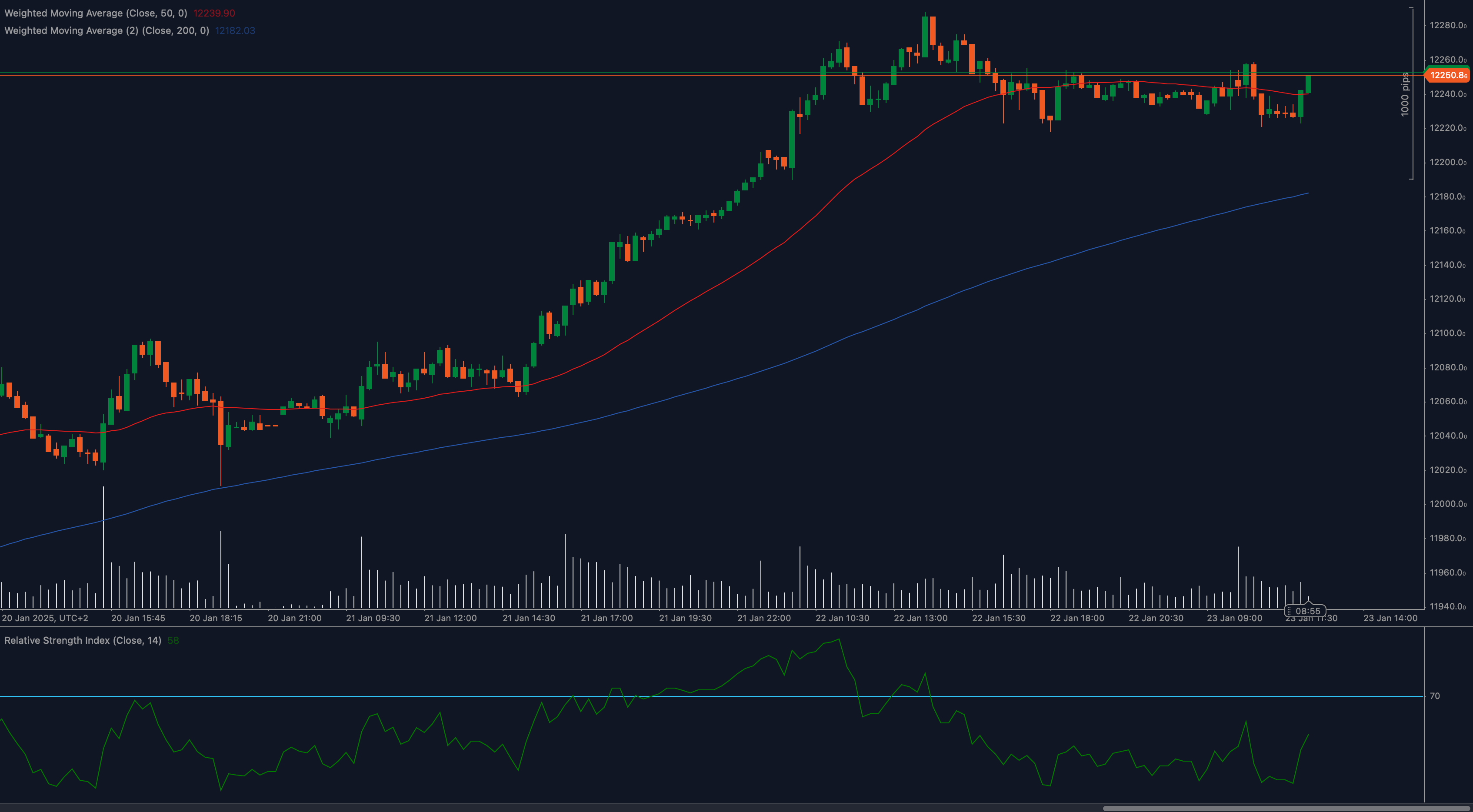

📈 Weighted Moving Averages Highlight Strength The 50 Weighted Moving Average (WMA) at 12,239 is trending above the 200 WMA at 12,182, reinforcing a bullish bias. This alignment suggests that buyers retain control as long as the price remains above these levels. A sustained break above 12,250 could propel the index toward 12,300, while a pullback might find support around 12,200.

📊 RSI Points to Momentum Challenges The Relative Strength Index (RSI) is hovering near 58, signaling bullish momentum but with caution. A move above 60 could confirm a breakout, while a drop below 50 might indicate bearish pressure.

🔎 Fibonacci Levels Indicate Key Support A Fibonacci retracement from the recent swing low of 12,100 to the current high shows the 23.6% retracement level aligning with the 12,200 support zone. This level could act as a buffer for any pullbacks, providing buyers with an opportunity to regain control.

Key Levels to Watch

Support Levels:

- 12,200: Immediate short-term support

- 12,182: Major level aligned with the 200 WMA

Resistance Levels:

- 12,250: Key resistance zone

- 12,300: Next bullish target if the breakout succeeds

Fundamental Drivers

The SMI has been buoyed by strong corporate earnings from Swiss heavyweights and robust economic data. However, global uncertainties surrounding central bank policies and geopolitical tensions remain key risk factors. Traders should watch upcoming macroeconomic data releases from Switzerland and Europe, as they could significantly sway market sentiment.

Outlook

The Swiss Market Index stands at a pivotal point. A decisive breakout above 12,250 would open the door to further gains, targeting 12,300 and beyond. Conversely, failure to break through this resistance might lead to consolidation or a pullback toward the 12,182 region.

Traders are advised to stay vigilant and adapt to any shifts in sentiment driven by macroeconomic updates or risk events.