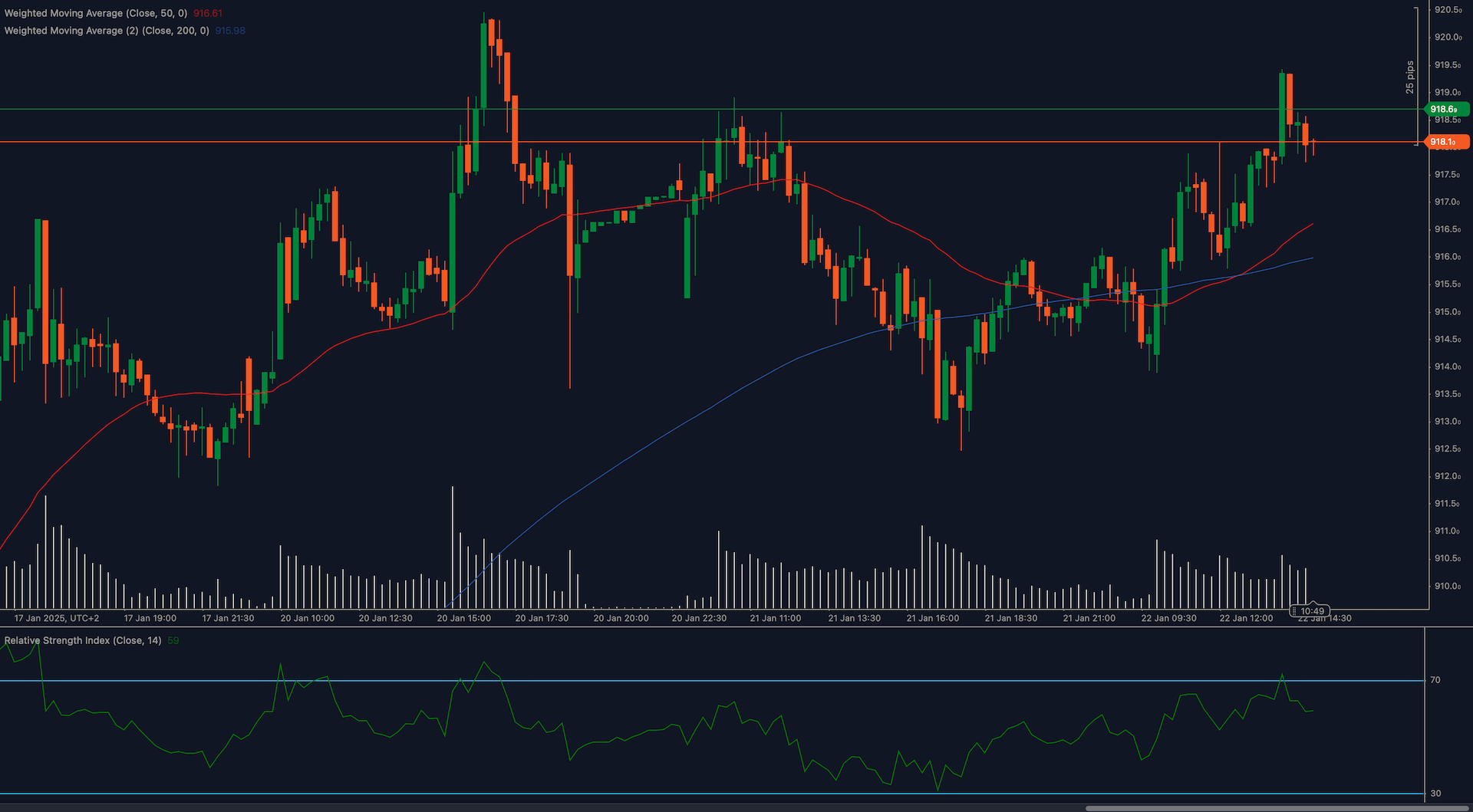

The AEX 25 index is navigating a pivotal moment as it challenges the 918.60 resistance level, a zone that has historically presented difficulties for bullish momentum. The broader market sentiment remains cautiously optimistic, but traders are closely watching this level to gauge the next move.

Recent economic data has bolstered risk sentiment, providing a supportive backdrop for equities. However, technical indicators suggest the potential for either a breakout or a pullback in the coming sessions.

Technical Analysis

📈 Moving averages reinforce the uptrend.

The index remains above both the 50 Weighted Moving Average (WMA) at 918.18 and the 200 WMA at 917.82, signaling continued bullish momentum. The upward slope of these averages suggests the trend remains intact. A successful breakout above 918.60 could see the index aiming for 919.50, while failure to overcome this resistance might trigger a pullback toward 918.18.

📊 RSI indicates neutral momentum.

The Relative Strength Index (RSI) is hovering near 59, reflecting a balance between buying and selling pressures. A move above 60 would signal renewed bullish energy, while a decline below 50 could tip the scale in favor of the bears.

🔎 Fibonacci retracement points to support.

Using Fibonacci retracement from the recent swing low at 917.00 to the current high at 918.60, the 23.6% retracement level aligns with the 918.18 support, providing a potential bounce zone in the event of a pullback.

Key Levels to Watch

- Support Levels:

- 918.18: Immediate support backed by the 50 WMA

- 917.50: A deeper level that could act as a buffer if selling intensifies

- Resistance Levels:

- 918.60: Current resistance being tested

- 919.50: Potential breakout target

Fundamental Drivers

The AEX 25 has benefited from improving corporate earnings and positive developments in the European economic landscape. However, potential shifts in ECB monetary policy and macroeconomic uncertainty remain key factors influencing investor sentiment. Traders should monitor these developments, as any surprises could lead to sudden market volatility.

Outlook

The 918.60 resistance level is a key test for the AEX 25. A breakout above this zone could propel the index toward 919.50, reinforcing the bullish narrative. Conversely, a failure to break higher might result in a pullback, with the 918.18 support level providing the first line of defense.

Market participants should stay alert to news developments and technical signals, as these could tip the balance in either direction.